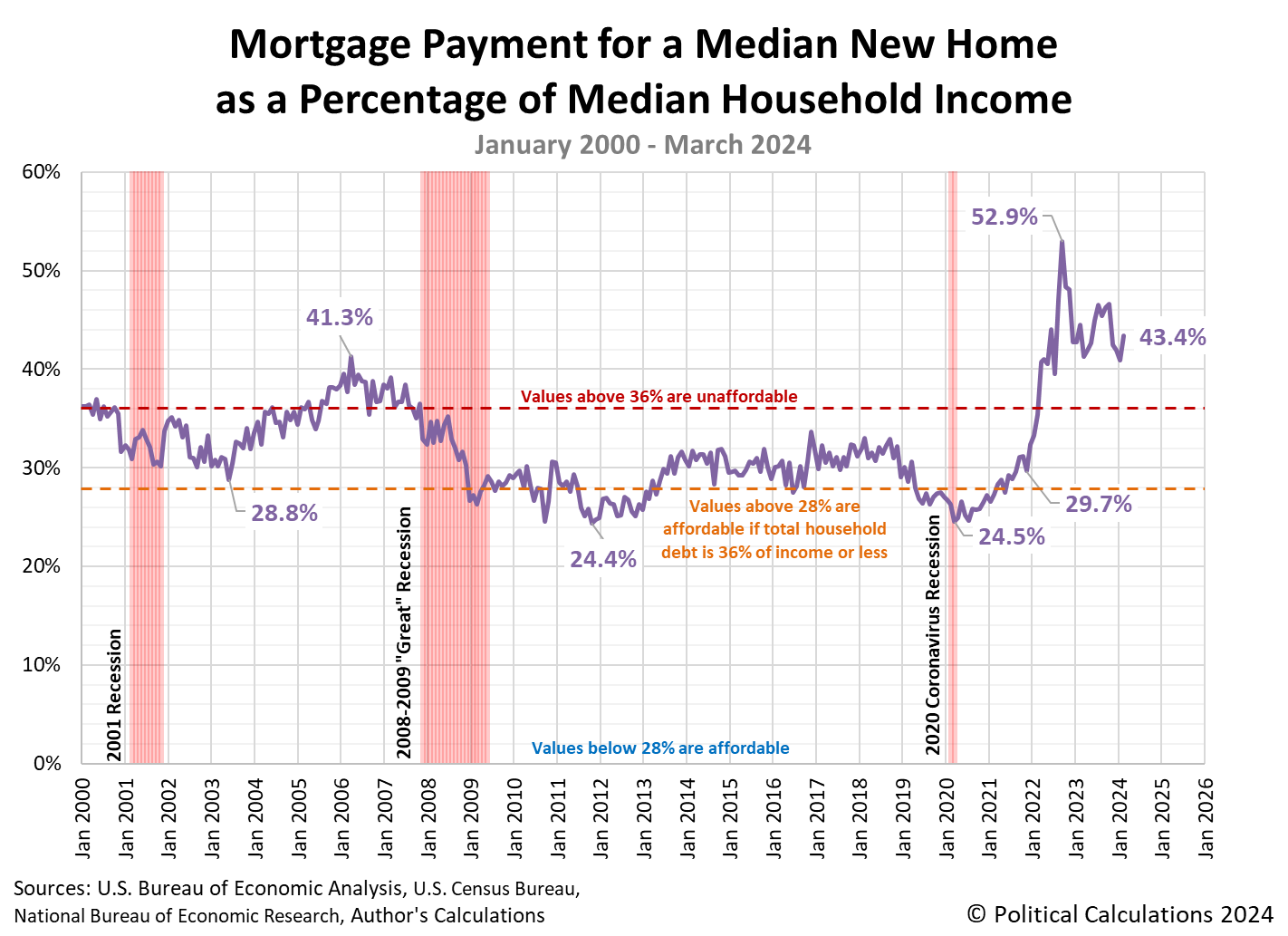

New homes in the U.S. became less affordable in March 2024. The median price of a new home sold rose to $430,700 and the average interest rate on a 30-year fixed rate conventional mortgage increased to 6.82% during the month. These two things together made the monthly payment on a new home less affordable than what it had been just a month earlier, which was already outside the threshold of affordability for the typical American household.

That's because the mortgage payment on a new home sold in March 2024 would consume 43.4% of the monthly income earned by an American household at the exact middle of the income spectrum in the United States. This measure of the relative affordability for a new home remains well above the 28% mortgage debt-to-income ratio and 36% total debt-to-income ratio thresholds that mortgage lenders set for borrowers to ensure they can afford their mortgage payments.

The mortgage payment for a median new home sold has consistently exceeded the 28% basic affordability threshold since February 2021 and the higher 36% affordability threshold since March 2022.

The following chart shows how the relative affordability of the typical new home sold in the U.S. has developed from January 2000 through March 2024.

The persistent inflation of new home prices that has taken place since February 2021 is changing the market for new homes:

The median new house price increased 6% to $430,700 from February. That was the highest level since last August. Prices, however, slipped 1.9% from a year ago. Most of the new homes sold last month were in the $300,000-$399,999 price range, followed by the $500,000-$749,000 price bracket.

Builders are constructing smaller and cheaper houses, but fewer of them are cutting prices. The NAHB survey last week showed the share of builders cutting prices fell to 22% in April from 24% in March and 36% in December. Fewer builders were also offering incentives to boost sales.

Overall house prices continue to rise because of the supply squeeze in the home resale market. Data from mortgage finance agency Fannie Mae last week showed house prices increased 7.4% on a year-on-year basis in the first quarter compared to a 6.6% rise in the fourth quarter. Fannie Mae upgraded its estimate for home price growth this year to 4.8% from 3.2% previously.

The resale market for existing homes has been devastated by the rise in interest rates that has taken place over this period. Many Americans households cannot afford to either buy or sell.

Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent.

Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower.

The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades. For homeowners not looking to move anytime soon, the low rates they secured during the pandemic will benefit them for years to come. But for many others, those rates have become a complication, disrupting both household decisions and the housing market as a whole.

Indeed, according to new research from economists at the Federal Housing Finance Agency, this lock-in effect is responsible for about 1.3 million fewer home sales in America during the run-up in rates from the spring of 2022 through the end of 2023. That’s a startling number in a nation where around five million homes sell annually in more normal times — most of those to people who already own.

Much of that pent up demand for housing has shifted to the new home market, which is preventing new home prices from falling to more affordable levels. It's a negative consequence from the interest rate hikes that have taken place to combat President Biden's inflation.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 April 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 April 2024.

Freddie Mac. 30-Year Fixed Rate Mortgages Since 1971. [Online Database]. Accessed 1 April 2024. Note: Starting from December 2022, the estimated monthly mortgage rate is taken as the average of weekly 30-year conventional mortgage rates recorded during the month.

Political Calculations. Median Household Income in March 2024. [Online article]. 1 May 2024.

Image Credit: Microsoft Copilot Designer. Prompt: "An editorial cartoon of a young family realizing they cannot afford a new house with a real estate agent".

Labels: personal finance, real estate

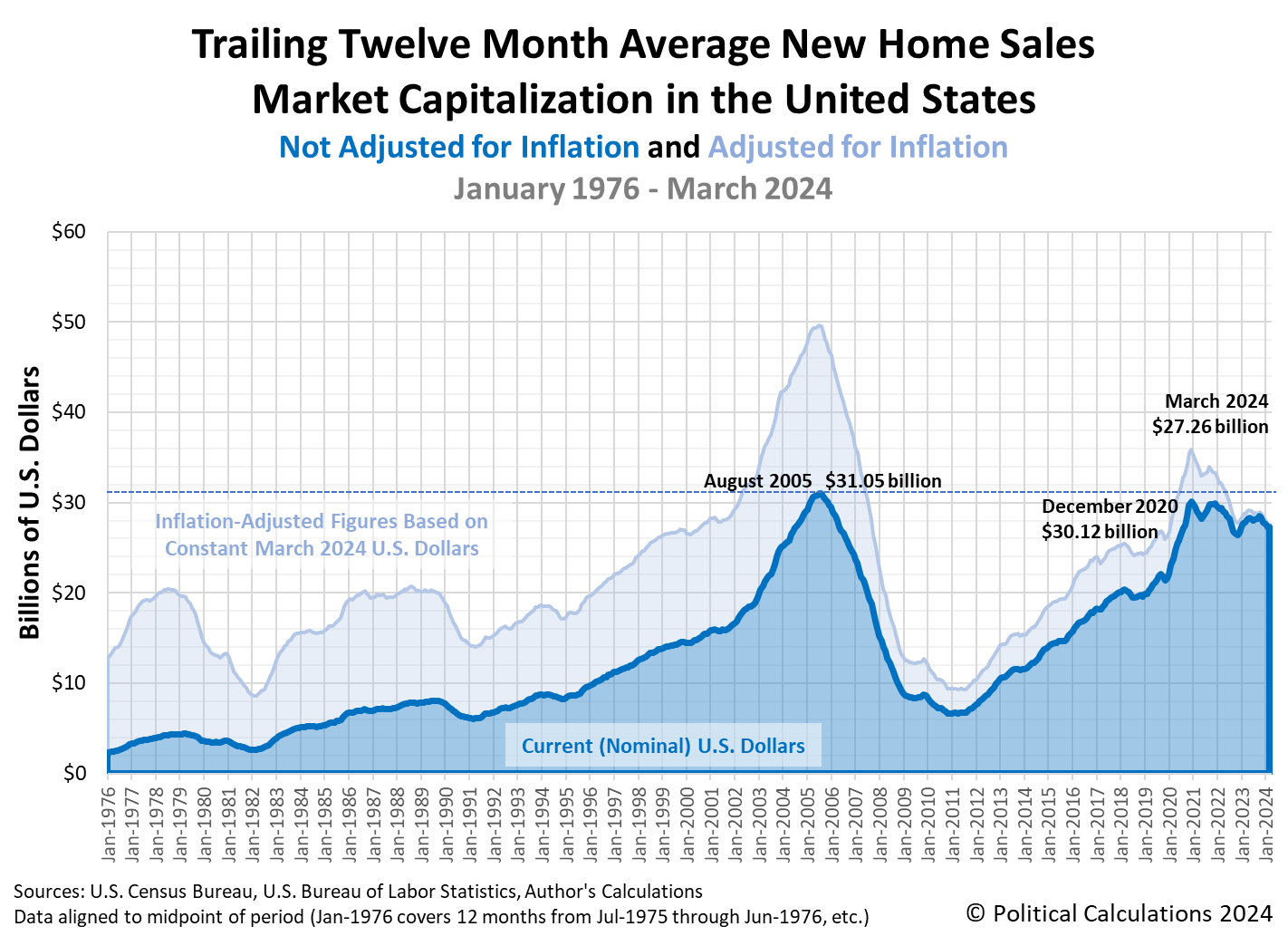

March 2024 was a good month for new home builders in the U.S. The month saw a rebound in the number of new home sales and also a rebound in the average new home sale prices over February 2024's depressed levels.

But that wasn't quite enough to definitively break the now six-month long downtrend we've been tracking for the industry, as measured by its trailing twelve month market capitalization. The market cap trend for new homes has been fading after having most recently peaked at approximately $28.46 billion in October 2023.

Likewise, the downward trends for the new home market's underlying number of sales and average sale prices remain intact, though the positive data for March 2024 contributed to slowing their descent.

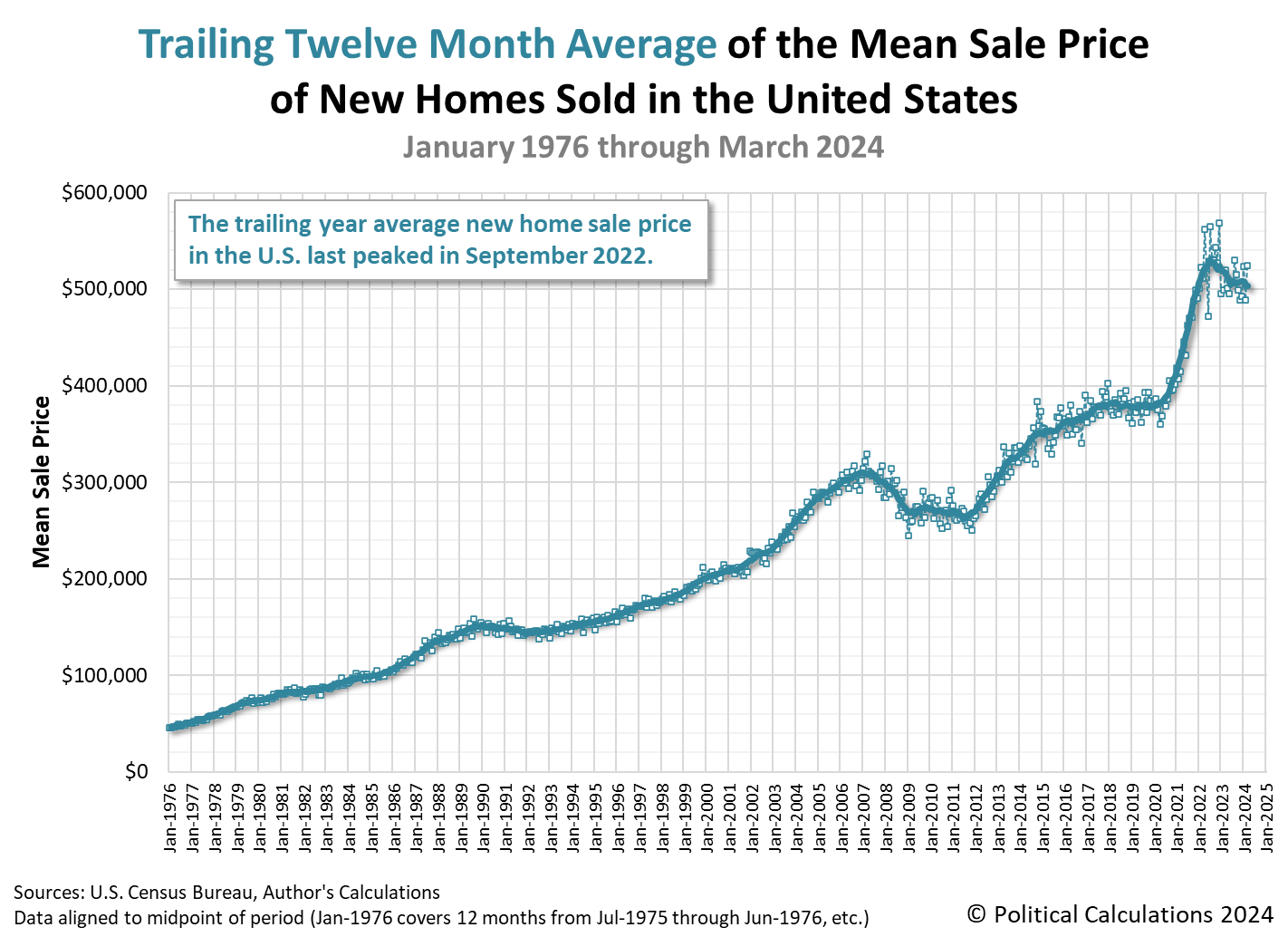

The following charts show the evolution of the U.S. new home market capitalization, the number of new home sales, and also new home sale prices as measured by their time-shifted, trailing twelve month averages from January 1976 through March 2024.

Ideally, we'd like to see the trend for falling new home sale prices continue and be coupled with a rising number of sales that more than offsets the decline in their average price to produce a rising trend in the new home market cap. That pattern would be positive for both new home buyers and new home builders. Unfortunately, there are forces at work in the U.S. economy that may make realizing that positive scenario difficult:

Sales of new U.S. single-family homes rebounded in March from February's downwardly revised level, drawing support from a persistent shortage of previously owned houses on the market, but momentum could be curbed by a resurgence in mortgage rates.

The report from the Commerce Department on Tuesday also showed the median house price jumped to a seven month-high from February, likely as fewer builders offered price cuts and sales shifted to higher priced homes. Rising prices and mortgage rates could make housing even more unaffordable, especially for first-time buyers.

We'll examine the relative affordability of new homes for the typical American household in the very near future.

References

U.S. Census Bureau. New Residential Sales Historical Data. Houses Sold. [Excel Spreadsheet]. Accessed 23 April 2024.

U.S. Census Bureau. New Residential Sales Historical Data. Median and Average Sale Price of Houses Sold. [Excel Spreadsheet]. Accessed 23 April 2024.

Image credit: New Home Construction by Paul Brennan on PublicDomainPictures.net. Creative Commons CC0 1.0 DEED CC0 1.0 Universal.

Labels: market cap, real estate

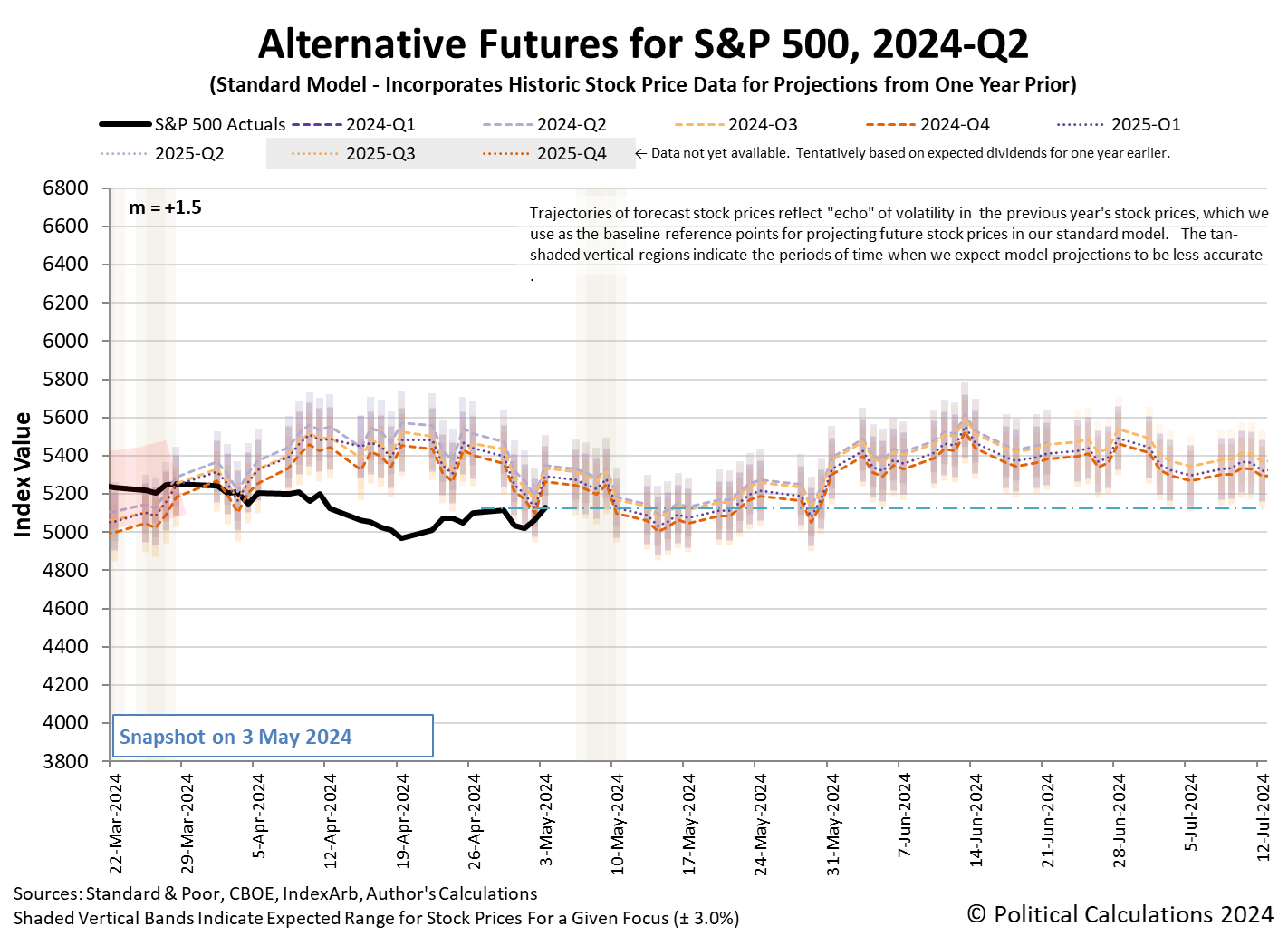

The S&P 500 (Index: SPX) was headed for a losing week, but got good news in the form of slowing U.S. job growth numbers late last week. While not necessarily as good for Americans, the news increased the likelihood the Fed will react to boost the U.S. economy by cutting interest rates more than once in 2024.

That prospect provided enough momentum for the S&P 500's to record its second up-week of the second quarter of 2024. The index ended the trading week at 5,127.79, up over 0.5% from where it closed the preceding week.

The CME Group's FedWatch Tool continued holding steady in anticipating the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 18 September (2024-Q3) for the third week in a row. However, the tool now projects the Fed will start a series of 0.25% rate cuts on that date that will continue well into 2025 at 12 week intervals.

The trajectory of the S&P 500 remained consistent with investors focusing on 2024-Q3 in setting current day stock prices. Moreover, the trajectory of the index looks set to rejoin the dividend futures-based model's projections associated with this future quarter in the next two weeks.

The deviation between the model's trajectories and the actual trajectory of the index is attributed to how the projections are generated. Because its projections are "locked-in" once it gets within a 30-day window of the present, if something unexpected happens to prompt investors to alter their outlook for the future within that period, it results in a short-term deviation between the model's projections and the S&P 500's trajectory. At least, until the trajectory gets outside the "locked-in" window of when the unexpected event began.

In a little over a week, the actual trajectory of the S&P 500 appears set to rejoin the model's projections that incorporate the information investors absorbed a little over 30 days earlier when an unexpected resurgence of inflation prompted them to push back their expectations for when rate cuts would start in the U.S.

Speaking of absorbing information, here's our summary of the market-moving headlines of the trading week ending on Friday, 3 May 2024.

- Monday, 29 April 2024

-

- Signs and portents for the U.S. economy:

- Oil dips on Israel-Hamas peace talks, slim near-term US rate cut hopes

- US regulators seize troubled lender Republic First, sell it to Fulton Bank

- Fed minions thinking about when, whether to cut interest rates in 2024:

- Bigger trouble, stimulus developing in China:

- China's Big Five lenders see margins shrink in the first quarter

- China industrial profits fall in March, stir doubts about economic recovery

- Chinese property shares rally on stimulus hopes

- BOJ minions start propping up yen:

- ECB minions excited Eurozone inflation is slowing:

- Central Europe's rate-setters have pause for thought

- ECB's Knot: increasingly confident about disinflation

- Nasdaq, S&P, Dow ended higher in a choppy session as investors shift attention to the Fed

- Tuesday, 30 April 2024

-

- Signs and portents for the U.S. economy:

- US labor costs increase more than expected in first quarter

- Oil falls to 7-week low on surprise US storage build, Middle East hopes

- Fed minions thinking about what to do with their balance sheet:

- Bigger trouble, stimulus developing in China:

- China's factory, services activity growth slows in April

- China to step up support for economy, flexibly use policy tools, Politburo says

- BOJ minions happy with data they like:

- Bank of Japan upbeat on consumption, service price outlook

- Japan March factory output rises as vehicle production recovers

- Growth signs in the Eurozone, ECB minions looking forward to rate cuts:

- Euro zone grows more than expected in Q1 after recession

- Euro zone inflation steady in April, reinforcing ECB rate cut case

- Nasdaq slides ~2%, Dow and S&P shed over 1% each as Wall Street ends April in the red

- Wednesday, 1 May 2024

-

- Signs and portents for the U.S. economy:

- Oil prices rebound after closing at seven-week low

- US job openings slide to three-year low as demand for labor gradually eases

- Fed leaves rates unchanged, flags 'lack of further progress' on inflation

- Fed's Powell says looming US election will not sway rate decisions

- FOMC holds rates in place and will slow balance sheet drawdown

- More Fed officials ready to say goodbye to low-rate world

- BOJ minions intervenes to support falling yen:

- ECB minions push back date Eurozone inflation will hit its target:

- Nasdaq, S&P, Dow's Fed-sparked gains cool off, but bonds rise as Powell says hike unlikely

- Thursday, 2 May 2024

-

- Signs and portents for the U.S. economy:

- Weak US productivity could threaten Fed's 'soft landing' hopes

- US high yield spreads still tight despite pick-up in distress

- BOJ minions get desired result after propping up Japan's yen:

- Bigger trouble developing in Eurozone as ECB minions get reason to cut interest rates:

- Euro zone factory activity takes turn for the worse in April, PMI survey shows

- ECB's Stournaras sees just three rate cuts in 2024 on strong growth

- ECB should accumulate data between rate cuts, chief economist says

- Nasdaq, S&P snap two-day losing streak while Dow also advances ahead of Apple results

- Friday, 3 May 2024

-

- Signs and portents for the U.S. economy:

- Oil settles down on US jobs data, steepest weekly loss in 3 months

- US job gains fewest in six months as labor market cools

- US service sector contracts in April; price pressures reaccelerate

- Fed minions thinking about what their inflation target should be, might try being clearer about what their dot plot rate forecast means:

- NY Fed’s John Williams says 2% inflation target is ‘critical’ for monetary policy

- Fed's Goolsbee: US rate-path 'dot plot' needs more context

- Fed's Bowman supports current policy stance but still sees inflation risks

- Dovish Fed, 'Goldilocks' jobs report helps S&P 500 notch back-to-back weekly gains

The Atlanta Fed's GDPNow tool is forecasting an annualized real GDP growth rate of 3.3%, down from its initial forecast of +3.9% growth in the previous week.

Image credit: Microsoft Bing Image Creator. Prompt: "An editorial cartoon of a Wall Street bull sitting up after having received CPR from a paramedic wearing a name badge that says 'RATE CUTS'".

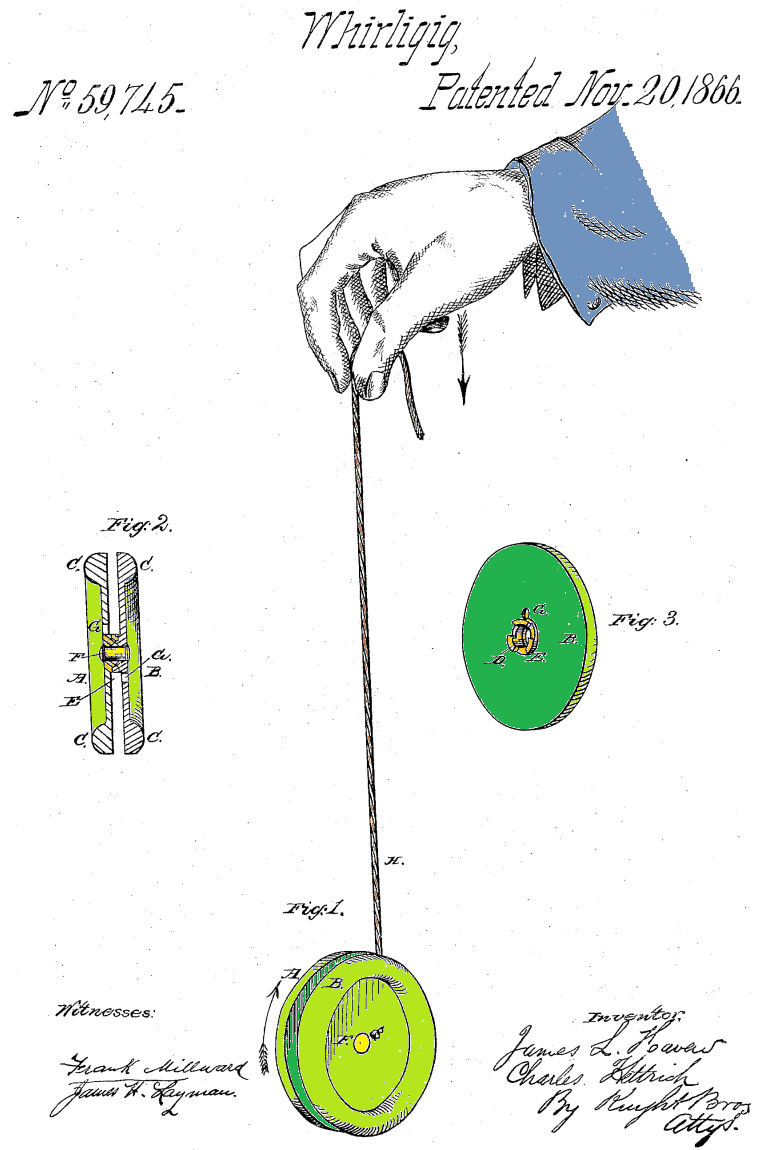

You know the old saying. "Invent a new and useful bandalore, and the world will beat a path to your door."

The Inventions in Everything team lives by that motto. And what better way to seek out new and useful bandalores than seeking them out among the more than ten million patents awarded by the U.S. Patent Office.

Although we had gone seeking the oldest patent for a different invention, we chanced across U.S. Patent 59,745, which was issued by the U.S. Patent Office on 20 November 1866. The patent's abstract proclaims the inventors' achievement:

Be it known that we, James L. Haven and Charles Hettrick, both of Cincinnati, Hamilton county, Ohio, have invented a new and useful bandalore, and we do hereby declare the following to be a full, clear, and exact description thereof, reference being had to the accompanying drawings making part of this specification.

By this point, you're probably wondering just what a bandalore is. As they used the word, it seems to have become a name lost to history, soon replaced by the more futuristic name that inventors Haven and Hettrick gave to their invention: The Whirlygig!

Oddly enough however, that name never caught on for the modern incarnation of what they invented. Their new and improved bandalore is much better known today as the yo-yo. Here are Figures 1, 2, and 3 from the patent illustrating their vision of a new and useful bandalore.

Although not as refined as what today's versions of it have become, Haven and Hettrick's invention is immediately recognizable as a yo-yo. Speaking of which, we easily found where you can buy the more modern versions of their "new and useful bandalore" in beginner, intermediate, and expert level models.

Unless you're an intense yo-yo enthusiast, its unlikely you'll ever come across the name "bandalore" in any product catalog. Perhaps it's a name that can be resuscitated in the future by the inventors of a new and useful whirlygig, which is a name that's now most closely associated with today's garden spinners. Stranger things have happened.

From the Inventions in Everything Archives

The IIE team has never previously featured a bandalore, but we have featured a couple of other inventions that fall into the category of "new and useful" toys:

Labels: technology

April 2024 proved to be yet another mixed month, on net, for the dividend paying stocks of the U.S. stock market.

By net, we're adding the positives and subtracting the negatives to be found in the month's dividend metadata. After doing that math for the month's favorable and unfavorable dividend changes, we ended up with a month-over-month net change of -10, which is to say the unfavorable changes mildly outnumbered the favorable ones. Year-over-year however, we find a more positive outcome. Favorable dividend changes outnumbered unfavorable changes by margin of 27.

For the month-over-month change, we had the positive of a reduced number of decreased dividends reported by Standard and Poor, which was more than offset by the negative of a reduction in the number of favorable dividend changes. By contrast, the year-over-year numbers are much less ambiguous. The number of favorable dividend changes rose while the number of unfavorable dividend changes decreased, which leads to its more positive score.

We're playing around with describing the dividend metadata this way because with so many moving pieces, getting to single values that describe how the dividend paying firms of the U.S. stock market performed could be useful. As for where the numbers we used to determine these net scores came from, the following table summarizes the values that S&P reported that encompass April 2024's dividend changes:

| Dividend Changes in April 2024 | |||||

|---|---|---|---|---|---|

| Apr-2024 | Mar-2024 | MoM | Apr-2023 | YoY | |

| Total Declarations | 5,367 | 5,306 | 61 ▲ | 3,169 | 2,198 ▲ |

| Favorable | 181 | 200 | -19 ▼ | 130 | 51 ▲ |

| - Increases | 124 | 130 | -6 ▼ | 91 | 33 ▲ |

| - Special/Extra | 57 | 67 | -10 ▼ | 39 | 18 ▲ |

| - Resumed | 0 | 3 | -3 ▼ | 0 | 0 ◀▶ |

| Unfavorable | 6 | 15 | -9 ▼ | 30 | -24 ▼ |

| - Decreases | 6 | 15 | -9 ▼ | 30 | -24 ▼ |

| - Omitted/Passed | 0 | 0 | 0 ◀▶ | 0 | 0 ◀▶ |

The following chart visualizes the monthly counts of dividend increases and decreases from January 2004 through April 2024.

With S&P reporting just six firms announcing they would reduce their dividends during the month, which is well below the threshold of fifty firms that corresponds with recessionary conditions that affect dividend paying firms in the U.S., we'll skip providing a breakdown of the affected industrial sectors this month.

Perhaps the most disappointing aspect of April 2024 is that its favorables were not stronger. Looking over the past 21 years for which S&P has reported its dividend metadata, April 2024 ranks in the bottom fifth for the number of announced dividend increases. Meanwhile, there were 57 special, or extra, dividends announced during the month, ranking it among the highest recorded for Aprils from 2004 through 2024. April 2024 is second overall only behind April 2014's total of 61 extra dividends announced.

That's where we find the cloud lurking in the silver lining of these favorable dividend changes. If U.S. firms were more confident they could sustain higher dividend payments into the future, we should see more dividend rises and fewer special dividend payments. April 2024's elevated number of extra dividend announcements instead suggests many of these firms do not anticipate being able to sustain higher dividend payments going forward at this time. Yet they can afford to pay a special dividend because of how well they've done in the very recent past.

In April 2014, the elevated number of extra dividends announced presaged a multi-year decline for the dividend paying firms of the U.S. stock market after reaching a high level. If the management of that era believed that their future business outlook would be less bright going forward than it had been, the message they sent with April 2014's extra dividend payments was right on the money.

Ten years later, what message do you suppose the management of the firms taking similar action in April 2024 are sending about how they view their prospects?

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 1 May 2024.

Image credit: The Minister of State (Independent Charge) for Consumer Affairs, Food and Public Distribution, Professor K.V. Thomas receiving a dividend cheque from the Chairman, Central Warehousing Corporation, Dr. C.V. Ananda Bose by Government of India on Wikimedia Commons. Creative Commons CCO 1.0 DEED CC0 1.0 Universal. Although this photo comes from India, we really like the idea of a really big dividend cheque!

Labels: dividends

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.