Welcome to the Friday, May 30, 2008 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts to be found in the best of the past week's business and money-related blog carnivals!

Welcome to the Friday, May 30, 2008 edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts to be found in the best of the past week's business and money-related blog carnivals!

Now that we've wrapped up our unexpectedly prolonged DIY Income Tax Code project, we're looking forward to finally getting away for a while! We'll be back next week with the next edition of OMM, so in the meantime, we're leaving you with all the best posts we found in the past week, some of which themselves were pretty unexpected. Until then, "I'm going to Disneyland!"

| On the Moneyed Midways for May 30, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Paid Off a Past Financial Mistake - The Car Loan | Single Guy Money | Originally, SingleGuyMoney was going to wait until he had enough cash to have $20,000 left over after paying off his car loan. Instead, he jumped the gun in paying the car off earlier than planned, leaving him with just $17,000 in the bank. And *that* worries him!... |

| Carnival of HR | 10 Things I Learned from Working in HR | Great Leadership | Dan McCarthy spent 18 months working in his company's Human Resources department and though he hated the experience, he appreciates how critical the role is to the success of business. |

| Carnival of Personal Finance | 12 Ways to Be Financially Boring | Save and Conquer | Called "boring" after announcing plans to save and invest the government's "stimulus" tax rebate rather than spend it, Save and Conquer counters by identifying 12 "boring" yet sound personal finance practices and declares that "boring" is where it's at! |

| Carnival of Real Estate | Are Short Sales Fake Listings? Part 1 | Sacramento Real Estate Blog | John Lockwood provides Absolutely essential reading! Short sales are supposed to save lenders money by trading a reduced payoff now in place of bigger losses later if the property goes into foreclosure. But they're not biting.... |

| Festival of Frugality | The Benefits of Saving Habits that Make You Look Poor | SavingAdvice.com | Shannon Christman finds that her family's frugality can be a benefit, especially if they act and dress the part! |

| Festival of Stocks | How to Turn $5000 Into $22 million? Lessons From One Successful Investor | FIRE Finance | Anna Scheiber was an IRS auditor who, after being thwarted from advancing her career, swore she would get back at the agency by becoming rich and never giving a penny of her profits up in taxes. The Best Post of the Week, Anywhere! |

| Carnival of Money Stories | Stepping Back in Time: Our Life Ten Years Ago | fivecentnickel | Financially speaking, where are you today compared to where you were ten years ago? Nickel steps into the wayback machine and identifies the things that made the biggest differences in coming out ahead over time! |

| Carnival of Money Hacks | Save Thousands of Dollars in Five Minutes or Less with My "Secret" Coupon Hacks | Erica.biz | When we saw the post title, our first thought was that Erica Douglass's post was going to be another one of those spam blogs. Instead, Erica presents some of the sharpest frugal shopping tips we've ever seen gathered in one place in Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

Is the United States slipping into recession? Perhaps the following chart will provide some insight:

Being naturally optimistic, we believe that the current position marked on the chart clearly indicates that the tide of recession is receding, and will continue to do so into the foreseeable future. We're just amazed that the method used to determine the probability that the U.S. would be in recession today forecast where we would seem to be one year ago.

Labels: recession forecast

Are you tired of today's income taxes? Do you find them too complicated? How frustrated do you get by not being able to figure out how much you'll either owe or get back from the government until you've spent hours and maybe hundreds of dollars actually preparing your Form 1040?

Are you tired of today's income taxes? Do you find them too complicated? How frustrated do you get by not being able to figure out how much you'll either owe or get back from the government until you've spent hours and maybe hundreds of dollars actually preparing your Form 1040?

Isn't there a better way to pay for all that government we get? One that's pretty transparent and doesn't load up on special tax breaks for politically connected people? One that can fairly apply income taxes across the full spectrum of the nation's income earners?

Here at Political Calculations, we don't know if your way might be better, much less just what your way might be, but we can put the tools in your hands that you can use to build a brand new income tax code from scratch!

But more than that, we can also show you how successful your new income tax system might be in collecting money compared to today's system, at least, for 2005-06, right along with working out how much your tax bill would be under your system so you can compare your actual tax bill with your proposed option.

And it all starts below....

Designing Your Tax Brackets

Previously, we showed that all you need to define a progressive tax rate schedule like the U.S. has today is just three points of data, which effectively define the following:

- The lowest tax rate and the maximum income level at which it applies.

- An intermediate "target" tax rate and income level that defines the transition between a steep progressive rate of taxation beginning at the first point and a less steep rate, which continues up to...

- The maximum tax rate and the income level above which it applies.

We've selected default data to show off some of the tool's capabilities. Yes, we can handle negative income tax rates to benefit those with low incomes! Yes, we can handle a perfectly progressive income tax system, with incrementally increasing rates that apply with increasing incomes up to a maximum level (just leave the middle "target" tax rate blank!) And we can handle even more! Just enter your ideal progressive tax rate structure into the first table below.

Of course, a progressive income tax rate structure is nice, but what if you want an easy way to explore a flat tax? Or maybe you'd like to see what would happen if you set up a taxable income cap like Social Security has? Then again, you might be the kind of person who would like to impose a super high income tax rate or surtax for those who earn super high incomes. Sure, you could play with the numbers you enter for the progressive tax rate data table above to get these effects, but wouldn't it be really nice if you had a super easy way to check out these possibilities?

If any of the above describes you, we have a solution for you. The "Super Tax" data table below the progressive tax data table will let you set up a special tax rate that will override part or all of the progressive rate tax table above so you can explore these possibilities! For example, if you enter $0 for the income level where your "super" tax rate begins, you'll have a flat tax system for whatever tax rate you enter! Alternatively, you could set the tax rate to 0% and the income level greater than $0, setting up a Social Security-style taxable income cap. Or set that super high tax rate that only applies to people earning super high incomes, while keeping your progressive tax rate structure in place.

Speaking of which, if you'd rather just stick to the progressive tax rate structure you've outlined in the first table, just leave the data entry field in the "Super" tax data table blank. It's all up to you!

Some Fun Numbers With Our Default Data

For 2005-06, for which we modeled the household adjusted gross income distribution, exemptions per tax return and compared your plan against the results of the tax rates in effect in that time, the minimum wage was $5.15 per hour. Someone earning minimum wage and working full time for a full year would make $10,712. Try that number and adjust the number of individuals represented on a return with an eye to the following table outlining the income thresholds for poverty for 2006:

| Poverty Income Thresholds for 2006 | ||

|---|---|---|

| Number of Individuals in Household | Single | Married |

| 1 | $10,348 | N/A |

| 2 | $13,696 | $13,314 |

| 3 | $16,004 | $15,992 |

| 4 | N/A | $20,163 |

So, not only did our default data fill the U.S. Treasury with the nearly the same amount of the taxpayer's cash as did the current tax code did from personal income taxes, our version of the tax code would virtually eliminate poverty for all working people. When you consider that the government will spend 4% of GDP in any given year, or rather, about half what it collected in 2006 in personal income taxes to fail to achieve the same goal, shouldn't we be considering re-doing the tax code along the lines that we've proposed?

Recently, the weekend edition of the Wall Street Journal presented an article looking at the summer job market (HT: E. Frank Stephenson), which found summer jobs this year to be in short supply:

In the real world, summer jobs are in short supply. Only about a third of teenagers are expected to work this summer, the lowest levels in 60 years, according to the Center for Labor Market Studies at Northeastern University. Summer youth employment has fallen from about 45% of teens in 2000, a downward trend made worse this year by the faltering economy.

The passage above cites a slowing economy as the driving factor lessening the supply of jobs being made available for potential teenage hires, however Division of Labour's E. Frank Stephenson wrote the WSJ to recognize that there's a job demand side of the picture as well:

Your Weekend Journal article "My Virtual Summer Job" (May 16) blames declining teen employment on "a downward trend made worse this year by the faltering economy." Maybe so. Or maybe the reduction in teen employment is caused by the other side of the market -- the demand side -- as increasingly affluent teens and their families forgo summer jobs. Instead of bemoaning that "only about a third of teenagers are expected to work this summer," you might consider the pleasant possibility that two-thirds of teens now have the option of traveling, attending camps, or merely relaxing during their summers.

E. Frank Stephenson

Chairman

Department of Economics

Berry College

Mount Berry, Ga.

Forgetting for a moment that "Sincerely, Donald J. Boudreaux" is the standard form for signing all letters to the editor originating from the econoblogosphere, let's look instead at what both the WSJ and Dr. Stephenson missed, which in this case turns out to be the proverbial elephant in the room: recent increases in the U.S. minimum wage.

We already know that the majority of all minimum wage jobs in the United States are held by people between the ages of 16 and 24, which coincides with the ages of those most likely to be in high school and/or college. Of people within this age group, those in their teenage years, Ages 16 through 19, make up 26.1% of the total number of minimum wage earners, at least as of 2005.

The reason why this is the case is very simple. Young people generally lack the training, education and experience that can command a bigger paycheck in the job market. In fact, even these unskilled and inexperienced young people who start out their work experience earning the minimum wage don't do it for very long. The National Small Business Association surveyed its members and discovered that 73% of their members gave their minimum-wage earning employees a raise above that level within five months of being hired.

Meanwhile, these small businesses make up a disproportionate number of the firms that hire these new workers at the minimum wage. In 1999, the Small Business Administration considered the distribution of low-wage workers by firm size and found that:

Smaller firms tend to have a greater share of minimum-wage workers than larger firms. Of all minimum-wage workers, about 54% work in firms with less than 100 employees, while 46% work in firms with 100 or more employees. In addition, about 66% of all minimum-wage workers are employed in firms with less than 500 employess [sic] compared to 34% who are employed in firms with 500 or more employees.

For reference, small businesses are generally those with anywhere from 5 to 99 employees, while mid-size businesses reach from 100 to 999 employees.

Now that we've set the stage of who earns the minimum wage and who pays it, let's see why increases in the minimum wage are driving teenagers out of the job market.

In July 2007, the federal minimum wage increased from $5.15 per hour to the current $5.85 per hour, an increase of 70 cents or 13.6%. Later this year, in July 2008, the federal minimum wage will again increase by 70 cents from $5.85 to $6.55, an increase of 12.0%, or rather, a total increase of 27.2% from $5.15 per hour from the first six and a half months of 2007.

But that's only the money that's paid directly to the minimum wage earner! Let's go beyond that paycheck and consider the total cost increase for our smaller business minimum wage payer.

First, let's set the benchmark. We find that at $5.15 per hour, if we assume our minimum wage earner works at a small business of 20 employees, has no vacation, sick leave or time off benefits, is paid weekly, does not contribute to a 401(k) plan and does not have health insurance through their employer (not unreasonable for the typical minimum wage earner, as most have this kind of coverage through their parents) and is paid by check, the cost to their employer runs about $8.41 per hour.

While much of this higher amount covers government mandated expenses, such as the employer's portion of Social Security and Medicare taxes, as well as both federal and state unemployment taxes and state workers compensation, administrative expenses of actually delivering the employee their paycheck make up a larger portion of the amount over $5.15 for a firm with just 20 employees.

Now, we'll keep all the same settings and increase the wage per hour from $5.15 to $6.55. At the higher minimum wage that will take effect this summer, the employer in this case will effectively have to pay $9.96 per hour to cover the cost of employing a minimum wage earner.

For all practical purposes, a minimum wage earner will now cost 18.4% more than they did just over a year ago. (As always, if you have different scenarios that you'd like to check out for yourself, you're more than welcome to use our tool to do so!)

Once we add today's higher rate inflation into the picture, you can see that the options for small business owners are limited. Between being squeezed for profits, higher costs of goods and services and now government-mandated higher labor costs, something has to give. At this point in the summer of 2008, hiring teenagers at the minimum wage to work a significant number of hours each week would seem to be it.

Perhaps teenagers have picked up on how unlikely it is they will get a job in this kind of high cost environment and have adjusted their expectations accordingly - traveling, summer camp and "relaxing" might look good in comparison.

As for unintended consequences, as minimum wage jobs vanish and prices rise, teens are spending less, at least according to USA Today. Teen apparel retailers are being pinched through slower sales as teens have less income.

But then, USA Today missed the elephant in the room as to why teens have less income these days as well....

Labels: minimum wage

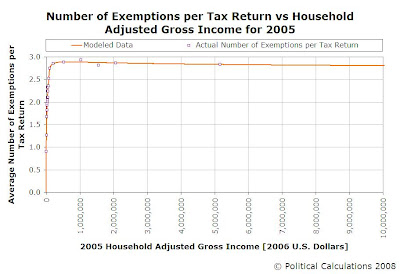

According to the IRS, in 2005, some 134,372,678 households in the United States filed personal income tax returns. On these tax returns, some 269,043,070 exemptions were claimed. Each one of these exemptions effectively represents one person.

According to the IRS, in 2005, some 134,372,678 households in the United States filed personal income tax returns. On these tax returns, some 269,043,070 exemptions were claimed. Each one of these exemptions effectively represents one person.

According to the U.S. Census, in 2005, the population of the United States was 295,895,897. So, just doing the quick math, we see that U.S. personal income taxes affect, or are affected by, 90.9% of the U.S. population.

That's a heck of a reach when you think about it! And because the number of people represented by each household has a significant impact upon how much those households pay in personal income taxes, our do-it-yourself income tax code tool will use this data to determine how much the federal government might collect from households at all income levels.

As it happens, this is the third of the three parts we need to reconstruct our lost tool. This data is important in that we'll be using it to directly account for personal income tax credits, which we find to be much more transparent than providing tax deductions that exempt income from taxation.

To that end, we've constructed a model of how these exemptions are distributed by household income level. The following chart gives the average number of exemptions per tax return against household adjusted gross income:

One of the more fascinating things we see in how these exemptions are distributed is that those at the lowest end of the income spectrum are by far the most likely to turn up as dependents on other people's tax returns! With federal income tax rules requiring those who can be claimed as dependents on other tax returns to enter zero for the number of exemptions they can claim, we see that the average exemptions claimed below $6000 (in constant 2006 USD) is less than one!

Meanwhile, we find that those making more than $35,000 average at least two exemptions per tax return, and for those households with adjusted gross incomes above $100,000, there are more than 2.75 exemptions per tax return!

The Tool

Update: 29 May 2008: Want to be able to extract the value that goes with a given household adjusted gross income level in that chart above? Here's the tool that goes with the chart!

Labels: taxes

Welcome to the Friday, May 23, 2008 edition of On the Moneyed Midways, the only weekly review of the best posts to be found in the best of the past week's business and somehow-money-related blog carnivals!

Welcome to the Friday, May 23, 2008 edition of On the Moneyed Midways, the only weekly review of the best posts to be found in the best of the past week's business and somehow-money-related blog carnivals!

If we go by our site traffic, it would seem that the Memorial Day holiday weekend has already begun! So, what do you say we just get right to it? The best posts of the week that was follow immediately below....

| On the Moneyed Midways for May 23, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | The Real Cost of Withdrawing Retirement Funds Early | Cash Money Life | Are you strapped for cash? Would tapping your retirement savings make sense? Patrick at Cash Money Life identifies the penalties you'll pay if you crack your nest egg open. |

| Carnival of Personal Finance | Mind vs. Brain Part II: Priorities, Pursuits & Productivity | The Financial Philosopher | Kent Thune wonders why the business world has a definition for productivity, but individuals don't for their own personal use in The Best Post of the Week, Anywhere! |

| Carnival of Personal Finance | Labour versus Investment Income | Quest for Four Pillars | Mr. Cheap considers which option of working for more income or investing for wealth is better, and along the way, reveals where Warren Buffett really gets his money (which explains why his income tax rate is so low!) |

| Carnival of Real Estate | Negotiation Tactics and Tricks | Real Estate Investing Adventures | If you've never been involved in a serious negotiation, Terry provides a basic primer on the kinds of tactics you can use, or that you might have to defend yourself against. |

| Carnival of Money Stories | Explaining Why Financially Independent Men Rarely Call Their Mothers | Money Blue Book | Absolutely essential reading for those mothers out there who wonder why their sons don't call - and it turns out to be good news! |

| Festival Of Stocks | Freddie Mac's Accounting Tricks Fool Investors | SOX First | Leon Gettler uncovers why debt-ridden and politically-connected Freddie Mac's stock rose after it reported less than expected levels of debt. Yes, it would seem that smoke, mirrors and arcane and perhaps inappropriately applied accounting regulations were involved.... |

| Cavalcade of Risk | Avoiding Risk | Cognition and Language Lab | Coglanglab unpacks a lot of Nobel prize winning insights in illustrating why the odds of winning are not evenly balanced against the risk of losing. |

| Money Hacks Carnival | No, I Won’t Accept Your Counter Offer | Cash Money Life | Patrick recently left his job for a new one, but before he left, his bosses made a counter offer. As his story demonstrates though, it came far too late and didn't address his core reasons for leaving. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

We've received the official word back from data recovery specialist eProvided.com. Sadly, the files on that USB flash drive whose ability to be recognized by Windows blinked out of existence could not be recovered.

We've received the official word back from data recovery specialist eProvided.com. Sadly, the files on that USB flash drive whose ability to be recognized by Windows blinked out of existence could not be recovered.

Of course, all that means is that we've lost a handful of files for which we had no backups, and of course, the do-it-yourself income tax code tool that we were going to unveil nearly two weeks ago now. Fortunately, Plan B has been in action, and we've completed re-coding two of the three main parts of it, so we have just a little bit further to go before we set it loose on the Internets!

In the meantime, in the memory of all that data that was on that Sandisk thumb drive, and your viewing pleasure, here's the late DeForest Kelley as Star Trek's Dr. McCoy with the official diagnosis:

Labels: none really

If you're a politician seeking

If you're a politician seeking to get campaign donations from a specific demographic group to give your constituents a break by lowering their income taxes, which method of doing so would you prefer to use: exempting a portion of their income from being taxed through deductions or providing tax credits to either lower taxes they pay or put money directly in their pockets?

Better yet, which method is more transparent?

Of course, if you're a politician, you're unlikely to care much about the issue of transparency in the tax code, because that would likely inconvenience you as you go about delivering those special benefits to those special people who make special contributions to you and perhaps your family members. But when choosing between using tax deductions and tax credits to do so, the answer is clear. It depends upon the incomes of the people to whom you intend to provide the tax break.

To understand why, let's turn to the U.S. Chamber of Commerce, who has considered the issue of whether tax credits or tax deductions are preferable where businesses are concerned:

When they're available, tax credits are generally better for you than deductions would be, because credits are subtracted directly from your tax bill. Deductions, in contrast, are subtracted from the income on which your tax bill is based.

So, a dollar's worth of tax credit reduces your tax bill by a dollar, but a dollar's worth of deductions lowers your tax bill by 35 cents if you're in the 35 percent bracket, by 33 cents if you're in a 33 percent bracket, etc. In cases where you have a choice between claiming a credit or a deduction for a particular expense, you're generally better off claiming the credit.

Going purely by the issue of transparency, tax credits beat tax deductions hands down. First, there's no question as to how they affect how much you'll pay in taxes, as the Chamber of Commerce example makes clear. Better still, if the tax credits reduce the amount of taxes you owe to the government below zero, you get to pocket the difference. There's no question as to how much they might impact how much you might pay in income taxes, and it's very easy to find out what you'll be compelled to pay to the government.

Another advantage is that they favor low income earners who would gain a larger percentage benefit than high income earners would from the same tax credit, which makes tax credits the vehicle of choice for the politician seeking the votes of those with low incomes. For example, for an individual making $25,000, a $2,500 tax credit represents 10% of their income. For an individual making $250,000, that percentage drops to just 1% of their income. Now, just consider how many people there are at each of these income levels, and you can see why a politician might favor tax credits as a means to attract the largest possible number of votes.

By contrast, tax deductions are anything but transparent. And with so many potential tax deductions, it's a miracle if anybody can figure out how much they might pay in income taxes in any given year before they take the time and effort needed to file their income tax returns.

We've provided an example of how the tax deduction racket works using the standard deduction of $5,350 for their 2007 income taxes, assuming an individual filing as either Single or Married filing separately. We'll assume that the amount by which an individual's taxable income is reduced is not enough to lower their income tax rate, which would provide an additional benefit for a very small number of people compared to the total pool of taxpayers:

| Amount Income Taxes Are Reduced for 2007 Standard Deduction by Tax Bracket | |

|---|---|

| Your Income Tax Rate [%] | Amount Your Income Taxes Are Reduced [$USD] |

| 10% | 535.00 |

| 15% | 802.50 |

| 25% | 1337.50 |

| 28% | 1498.00 |

| 33% | 1765.50 |

| 35% | 1872.50 |

This example demonstrates that even though the amount of the tax deduction (or rather, the amount of income exempted from being taxed) is the same, we find that the resulting outcome is somewhat less than transparent. Would you, for instance, have recognized that the same tax deduction would so strongly tilt in favor of those with the high incomes that correspond with the highest income tax rates?

Now, consider all the things for which itemized deductions exist. Things like the mortgage interest deduction. Or deductions for medical and dental expenses. Or moving expenses. Or shipping your car and your pets to your new home. Or any of these really weird deductions. Is it even possible to figure out how much you'll pay in income taxes before you do a mountain of paperwork?

Before you get really upset, let's also consider who's doing most of the income tax paying in the United States. Politicians have long recognized that if they want to keep getting the campaign contributions they require to keep getting elected, they need to keep their biggest donors happy. And that means cutting them special breaks. Why, if you believed the lobbyists for the National Association of Realtors, to cite just one example, special tax breaks are needed for new homeowners because, if they weren't provided, people will just pull up stakes and stop living in houses altogether!

Okay, that last example was a bit sarcastic, but really not that far off the truth. In reality, the only real reason these less-than-transparent tax breaks exist is because they were necessary to get high income earners to keep working hard enough to keep the tax money flowing in at levels that keep politicians in power. The money actually collected by the government is used to fund any number of government programs whose sole real purpose is to deliver the maximum number of votes possible to the politicians who fund them.

Ultimately, we have such high income tax rates on the highest income earners in the U.S. for the dual purpose of allowing politicians to exempt large portions of their special friends' incomes from taxation while making a large number of people dependent upon government-sponsored programs and benefits for their livelihoods feel good by making other people who make more money pay for them.

Wouldn't it just be nice to cut out all the noise?

Update: It does occur to us that there might be a situation in which a tax deduction might be fully transparent to all taxpayers. In the unique circumstance of a single flat rate income tax, a tax deduction exempting a specific amount of income for all taxpayers would qualify as being transparent. Then again, it would be no different from a tax credit equal to the amount of income exempted multiplied by the flat tax rate, so why not just call it that and be honest about it?!

Labels: taxes

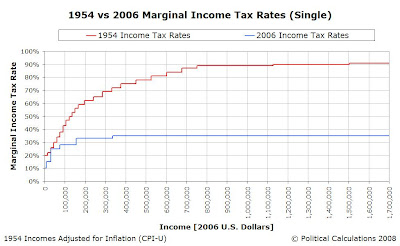

Ready for a public policy version of the popular game show? Let's get started with the answer - stand by to select the correct question!:

Answer: Between 7.2 and 8.8 Percent of GDP

And now the questions:

- How much money can the government reasonably expect to collect in any given year from today's personal income tax rate structure?

- If personal income taxes were raised to the levels of the 1950s, as suggested might be necessary to support the level of benefits promised under current law by a recent CBO study (HT: Greg Mankiw for the pointer), how much will the government collect once the higher taxes are fully phased in?

The clock's ticking! Have you selected a question to go with the answer?

Before you commit yourself to your question, here is a really nice discussion that helps explain why the results are as they are. (Note: The higher percentage of GDP identified in the article represents the results of collecting taxes from all sources, not just personal income taxes.)

Did you get it right? And if you don't believe the answer, maybe you should take some time to explain why the evidence doesn't back you up....

Labels: taxes

It turns out that the United States' income tax brackets really aren't very complicated.

Really. We're not kidding!

Although we can certainly understand why people might think so. After all, the reason they seem to be complicated is because the bureaucrats and politicians behind the tax code work hard to make it difficult to understand.

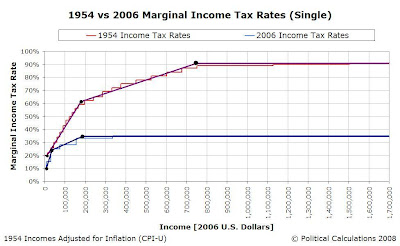

But, as we'll show you, how those tax rate schedules are put together really isn't all that tough. First, let's revisit our chart comparing the tax rate schedules of 1954 and 2006, in which we've adjusted all the income figures to be in 2006 U.S. dollars:

Right off, we see that 1954's schedule of tax rates looks really bad, featuring some 24 individual income tax brackets. By contrast, 2006 looks simpler, but still has no fewer than six unique tax brackets.

But, what if we told you that for all practical purposes, the tax rate structure for each year only has three points that matter?

It's true! In our recent project in which we created a do-it-yourself tool that you can use to design your own tax code (for which we're reconstructing the individual components lost when the USB flash drive on which it was stored went belly up - we should find out early this week if we'll have to rebuild the entire tool altogether), we found that we could approximate all those "stair steps" representing the U.S. tax code for both 1954 and 2006 by connecting just three target points with straight lines. The following chart, in which we've modified our tax rate schedule chart by showing the points and straight lines connecting them, illustrates just what we mean:

We can now see that all that stair-stepping is just a way that the designers of the U.S. income tax code use to set a single tax rate between given income levels. All that has changed over time is the steepness and width of the steps, which determines how closely the tax rate schedule follows the lines connecting these three points.

Speaking of which, those three points effectively define the following:

- The lowest tax rate and the maximum income level at which it applies.

- An intermediate tax rate and income level that defines the transition between a steep progressive rate of taxation beginning at the first point and a less steep rate, which continues up to...

- A maximum tax rate and the income level above which it applies.

As part of our reconstruction project, we're presenting a tool today that can approximate the income tax rate that applies for a given level of household income. You can enter data related to the three points that pretty much define the U.S. income tax rate schedule into the tool below, and we'll find the personal income tax rate that coincides with it. The default data in the tool is what we estimate are the three points for the 1954 version of the U.S. tax code!

Note: The "Super Tax" option in the tool below allows you to set either a tax rate above the "maximum" tax rate on earned income, or alternatively, you can set up a tax system similar to how the taxes for Social Security work, with a 0% rate that applies for incomes above a given level (a taxable income cap!) Otherwise, if left blank, the regular "maximum" tax rate applies for all incomes above the threshold you enter. This is a unique feature of the do-it-yourself tax code design tool that we're waiting to find out if we'll be able to recover....

If you opted to set a taxable income cap, when personal income taxes are determined, households with incomes above the taxable income cap would pay income taxes on all their income up to that threshhold at the rate that applies for that maximum taxable income (just like they do for Social Security, which has a similar tax structure!)

More than that though, this tool reveals that the process by which the U.S. sets these income tax levels is obsolete. That process might have made a lot of sense back in the days before calculators and computers were common household items in the U.S., when people would have to refer to printed income tax instruction books to determine what tax rate applied for their household income level, but we find that the case for this approach is much less than compelling in today's world.

Why not just have a tax code where you can find your tax rate by punching in your household income into an online tool?

Welcome to the Friday, May 16, 2008 regularly scheduled edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts to be found from the best of the past week's business and somehow-money-related blog carnivals!

Welcome to the Friday, May 16, 2008 regularly scheduled edition of On the Moneyed Midways, the blogosphere's only weekly review of the best posts to be found from the best of the past week's business and somehow-money-related blog carnivals!

As we suspected we might in the last edition of OMM, we're still working around the loss of the tools that we use to make assembling each week's edition of OMM a breeze. With any luck, we'll be back up to full speed with next week's edition.

Meanwhile, this was a much better week than average for finding lots of high quality posts across the breadth of blog carnivals that we survey! The best posts of the week that was follow below....

| On the Moneyed Midways for May 16, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Our Car Loan Is Officially Paid Off - In Less Than Two Months! | Chief Family Officer | Cathy reveals how she shattered her family's previous record car loan payoff time of four and a half years in applying sharp buying skills along with sound debt management. |

| Carnival of HR | Insights on Exit Process | Tvarita Consulting's Weblog | What can you learn about exiting employees while applying what you find out toward avoiding an exodus of skilled people from your firm from an India-based HR and Finance consulting firm? Quite a bit, if this slide-show presentation posted by Gautam Ghosh is any indication! |

| Carnival of HR | Telecommuting: Solid Ammunition but No Silver Bullet | i4cp Trendwatcher | With high gas prices, we suspect a lot of firms are considering telecommuting policies. Lary Crews identifies the pros and cons of working from home, looking at costs, savings, morale, employee retention, and potential impacts to doing business. |

| Carnival of Personal Finance | 10 Steps to Avoid Becoming a Millionaire | No Debt Plan | Kevin reveals the secrets you need to remove any shot you have to become rich like a Republican! Absolutely essential reading! |

| Carnival of Real Estate | Home Owners Want To Be Lied To.... | Minneapolis Real Estate Blog | A homeowner asked Jennifer Kirby to be "brutally honest" in assessing their house and what price it should be listed on the market. Find out how she lost the listing to another agent who told the owner what they really wanted to hear. The Best Post of the Week, Anywhere! |

| Festival of Frugality | Craigslist vs eBay | I've Paid for This Twice Already…. | PaidTwice compares her experience in using both Craigslist and eBay in selling things she no longer needed and finds that each site has unique advantages for different circumstances. |

| Festival of Stocks | Macau Play: Melco PBS (MPEL) - On the Up and Worth a Gamble | Saving to Invest | Would you gamble on buying stock in a Chinese casino? Andy has lost money on the stock for Melco PBL Entertainment (MPEL) but believes that it has good potential in the medium-to-long term. |

| Festival of Stocks | Ingersoll-Rand (IR): Earnings Analysis | College Analysts | James Cullen thinks that Ingersoll-Rand's (IR) recent purchase of Trane will help it break from being a heavy cyclical stock, but for now, it's trading that way, which means there's a real opportunity for investors to make gains. |

| Carnival of Money Stories | Best Financial Move in College #1: I Attend a Public University | BripBlap | BripBlap had full scholarship offers to a number of good universities, but ultimately chose "Hometown State," which not only led to a degree that led to a good job, but also made it possible to start life after college with money in the bank and no debt. Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

JPMorgan Chase CEO Jamie Dimon recently attracted attention with his comments that a U.S. recession is just now beginning:

"Even if the capital markets crisis resolves, it does not mean that this country will not go into a bad recession," said CEO James Dimon, whose bank saw its first-quarter profit fall by half due to the recent collapse of the U.S. mortgage market. "The recession just started."

That contradicts a lot of mainstream media reporting, which has created the impression that a recession has been well underway since the beginning of the year. It also contradicts what the stock market would seem to be telling us as well, as it would seem to be not going along with the media's "we're already in the worst recession ever" narrative.

We wondered what if Jamie Dimon is right? While we would expect that as the CEO of a major financial institution that he would be seeing the most distress in the U.S. economy, given that the financial sector has born the brunt of the bad economic news to date, what other data is there that might point to the economy going into recession just now?

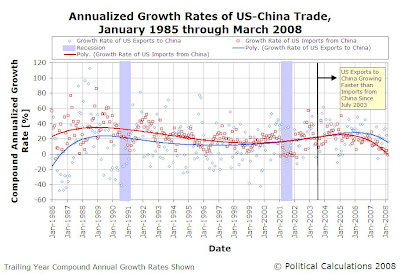

Or rather, what data can we use to put our fingers on the real-time pulse of the U.S. economy? It then struck us that we already had a pretty sensitive way to visualize how the U.S. economy is doing that is independent of the banking and financial sector of the U.S. economy: the growth rate of imports from China.

Or rather, what data can we use to put our fingers on the real-time pulse of the U.S. economy? It then struck us that we already had a pretty sensitive way to visualize how the U.S. economy is doing that is independent of the banking and financial sector of the U.S. economy: the growth rate of imports from China.

Here's why that might work. When the U.S. economy is growing, people buy goods that may be produced elsewhere in the world to satisfy their demand. Since China produces large quantities of consumer goods, things that people tend to buy more of in good economic times and less of in not-so-good economic times, the year-over-year growth rate of trade between the U.S. and China can be used as a near real-time measure of how the U.S. economy is doing.

Going to our data, we noted that back in 2001, during the last recession, the growth rate at which U.S. imported goods and services from China dropped to roughly zero, staying at that level throughout the entire period in which the NBER found the U.S. economy to be in recession. And if we look at the most recent data, we see that same phenomenon is taking place today:

A quick side note before we continue: While we see the year-over-year growth rate of imports from China going to zero both today and back in the 2001 recession, we don't see a similar pattern in the preceding recession of 1990-91. Our speculation is that with China having just undertaken major economic reforms to open up international trade in the mid-1980s, the level of U.S.-China trade was not yet established enough to be negatively affected by this recession.

More interesting, we see that the rate of growth of China's exports to the U.S. has been declining steadily since January 2007, in contrast to the sharp drop coinciding with the 2001 recession.

Meanwhile, we see that the level of the United States' exports to China has also been declining since January 2007, which suggests that the Chinese economy is slowing down as well.

And it would appear to us that our prediction from 2007 that the U.S.' so-called "trade deficit" with China might have permanently topped out might very well be spot on.

Labels: recession forecast, trade

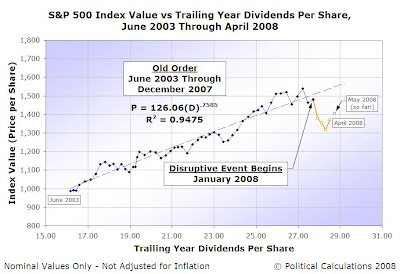

We've updated our signature tool The S&P 500 at Your Fingertips with all the latest data through April 2008 and we can't help noticing that for all the crises we've seen in the financial and housing sectors since January, the stock market is only seeing, at worst, minor erosion.

We've updated our signature tool The S&P 500 at Your Fingertips with all the latest data through April 2008 and we can't help noticing that for all the crises we've seen in the financial and housing sectors since January, the stock market is only seeing, at worst, minor erosion.

Don't take our word for it. Here's our chart showing the previous order that existed in the stock market along with the current disruptive event that began in January 2008 (and a peek at where the market is as of the close of business of 13 May 2008):

Our primary tool for measuring the level of distress in the stock market is the price-dividend growth ratio, high levels of which often correspond to recessions in the U.S. economy.

The key element that drives sharp increases in the stock market's distress level is the year-over-year rate of growth of dividends per share. For the level of distress to really soar, this rate of growth has to decline to a value of zero. This happens when companies, in looking at what their ability to pay dividends to their shareholders from their future earnings (profits), either freeze or reduce their dividends per share to avoid liquidity and other financial survivability issues.

As of this writing, with the exception of financial companies, that doesn't appear to be happening in any meaningful way. Standard and Poor's MarketAttributes Snapshot for the S&P 500 for April 2008 describes how things have played out so far this year (Note: the link will take you to the most recent edition of the MarketAttributes Snapshot - we weren't able to locate a permanent link to an archived edition):

Year-to-date, there have been 117 dividend increases versus 129 increases for 2007 and 17 decreases versus 2 decreases in 2007 (15 of the 17 decreases are Financials). The cuts have come from large Financial issues, and they have been deep. So while the 117 increases added US$ 9.18B in payments, the 15 Financials decreases took away US$ 9.96B which is 6% of the stimulus plan going out.

Note: The "stimulus plan" referred to above represents roughly 1% of U.S. GDP. For math-challenged journalists, the net decrease in dividends per share is US$ 0.78B for the year-to-date, or 0.5% of the stimulus plan going out.

In other words, the damage to the overall stock market from the problems of the mortgage lenders, investment banks and other financial institutions has been very much limited to this sector. With higher levels of earnings anticipated later this year, the stock market will not develop the high levels of distress associated with recessions in the U.S. economy.

But then, that may be because a recession this year is growing increasingly unlikely, at least, according to the WSJ, the NYT and, well, us!

Labels: SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.