We could just as easily called this post "King's Birthday Math," as King Banaian marked Milton Friedman's birthday by presenting the math that underscores one of Friedman's greatest insights:

Inflation is always and everywhere a monetary phenomenon.

We'll let King take it from here:

I have been teaching intermediate macroeconomics this summer, using the textbook of our current central bank chair (along with Andrew Abel and Dean Croushore), and we just finished the chapter on money. Towards the end of that chapter we teach the relationship between inflation and growth of the money supply. There's an equation which I can try to recreate here in words:

inflation = growth in money supply - (income elasticity of money)x(growth of real GDP)

which assumes relatively stable velocity of money in the short run. Friedman had insisted that "inflation is everywhere and always a monetary phenomenon", and I suggested we use that equation to see where we are now. I tend not to make exact measurements in class, so if I do a little rounding here you can hopefully make adjustments if you want something a little more precise.

Today's GDP report for Q2 puts the growth of GDP at about 2%. Friedman had followed the quantity equation to make the income elasticity of money equal one. Other research puts the number closer to 2/3 or 0.7 (the Baumol-Tobin approach makes it the inverse of the square root of 2, which is roughly 0.71). People tend to economize on cash holdings as they become wealthier, so a result for that number less than 1 makes sense.

For money, I used M2 in class (you can look at other rates here or get the raw data and do your own; see also Mark Thoma for a primer on different velocities of money). The average growth rate appears to be around 6% for the recent data.

If you accept those data, then, what would you get? Assume the income elasticity is 2/3 and the growth of GDP is 2%, and your answer would be 4.33% inflation. Assume income elasticity is 1 and you get 4%.

Now, here's where we come in! We've taken King's formula and built a tool in which you can not only calculate the expected rate of inflation, but to do so using your own assumptions about what the correct values to use are. As an added bonus, you can also run the numbers with the latest available data. Our default data is drawn from King's discussion:

King has already run other estimated values:

If you use 2.7% for the long run growth rate of potential GDP as CBO estimates, an expected inflation rate for the long term of 3.4% is quite reasonable for an assumption that M2 money growth stays at current levels for some time into the future. That target inflation rate of 2% is increasingly looking like it's out the window. The Fed's gift to Friedman on this birthday should be a Fed funds rate increase at its next meeting.

Our expectation is that the Fed's Open Market Committee will give Friedman just that kind of gift at their next meeting!

Labels: economics, gdp, gdp forecast, inflation, tool

Not long ago, we asked if it were possible to have an economic recession without ever having the GDP growth rate drop into negative territory.

Thanks to today's revisions in previously reported quarterly GDP growth rates, we can now say we've had at least one quarter with negative GDP growth rates: the fourth quarter of 2007. We've modified our GDP bullet charts appropriately to show the latest data - the bullet chart on the left provides the one-quarter annualized GDP growth rates for 2007Q4, 2008Q1 and 2008Q2, while the bullet chart on the right provides the annualized GDP growth rates spanning the two-quarter periods ending with 2007Q4, 2008Q1 and 2008Q2, which span the previous 12 months:

|

|

|---|

The latest data shows that the annualized one-quarter GDP growth rate for 2007Q4 did indeed turn negative, coming in at -0.2%. Meanwhile, we see that the annualized two-quarter GDP growth rate for 2007Q4 dipped to 2.3%, the difference in the figures reflecting a sharply slowing economy.

Real (inflation-adjusted) GDP for 2008Q1 has been adjusted to be slightly lower than previously reported, coming in with an annualized one-quarter growth rate of 0.9% as opposed to the previously reported 1.0%. The two quarter annualized GDP growth rate for 2008Q1 is 0.3%, confirming a significant slowdown in the U.S. economy covering 2007Q4 and 2008Q1.

The current quarter comes in at higher levels, with a one-quarter growth rate of 1.9% and a two-quarter growth rate of 1.4%. This is consistent with a slowly growing economy. We also see this reflected in our bullet chart, as these growth rates fall into the "cool blue" portion of our economic growth "temperature spectrum." The temperature spectrum itself is based upon typical U.S. economic performance since 1980, which provides a means of visually comparing recent GDP growth against its historic performance in the modern era.

All in all, today's data revisions confirm what we already knew: the U.S. economy significantly slowed down in the last quarter of 2007 and has been slowly improving since. Once again, we're amazed at how well this performance has tracked Jonathan Wright's recession prediction model:

We can see in the chart above that the highest probability of recession was established during the fourth quarter of 2007, with heightened probabilities that the U.S. would be in recession extending through the end of April 2008. We are now in a period where the probability the the U.S. will be found to be in recession is receding rapidly.

Finally, we can also confirm that First Trust's Brian Wesbury's optimistic forecast for 2008Q2 was very likely too optimistic. As we've seen from today's GDP revisions, the data may change.

Labels: data visualization, gdp, recession forecast

You've seen the clowns who run the Congress. You know that you could do a better job doing their jobs than they ever could. But there's still a nagging question whose answer is holding you back from really committing yourself to run for public office:

You've seen the clowns who run the Congress. You know that you could do a better job doing their jobs than they ever could. But there's still a nagging question whose answer is holding you back from really committing yourself to run for public office:

Should you?

The answer is that it depends. What if you have an skeleton in your closet like Alaska's Senator Ted Stevens? What if you're in 2008 Democratic presidential candidate John Edwards' alleged predicament? How might you know if now is your moment to run for office?

Sure, you could hire a political consultant who will charge way too much money to poll the public on the issue for you, but why bother with some lowlife polling hack when all you need is a tool you can anonymously use to evaluate your real chances of getting elected despite how you've lived your life?

Geek Logik's Garth Sundem summarizes the matter better than we can:

Your first consideration in choosing whether or not to run for public office should have nothing to do with your chances of actually winning. Of greater concern are the skeletons in your closet, which now may only occasionally rattle their chains but were you to run for office would burst forth to wander the night in search of human gray matter while moaning something about an "angry fix."

But how far back into your past should you go? Garth continues:

Along with your debauched exploits as an undergrad, other negative factors that should make the would-be candidate turn tail and run include: romantic partners that contradict your marital status; "creative" solutions to common financial burdens (e.g. taxes), drugs (oops! - I mean medications); and, time spent as a roadie for the Monsters of Rock tour.

Maybe you have these particular issues in your past, maybe you don't. Either way, Garth worked out the math behind these considerations for the tool below, which we're pleased to present in this political season. Just enter the indicated data to see if this is your moment or if you really shouldn't be seen anywhere near a public office. We'll have more comments below the tool....

The threshold for tipping the scales for when you should consider running for public office is a Candidate Index Factor of one or more. We provide this bit of insight so you can play with the tool to see what you might need to change in your life to qualify as a political candidate.

Speaking of which, Garth Sundem provides the final thoughts for doing this political calculus:

As we have all learned, despite a combination of such detracting factors it is still possible to hold event hte country's highest office. As long as your vices are balanced by charisma and connections, you too can tour the world reading teleprompters and vomiting on world leaders.

Indeed.

Labels: geek logik, politics, tool

The Tax Foundation does a lot of stuff right, but presenting data well isn't necessarily one of those things.

Here's an example. The Tax Foundation has ranked individual U.S. states according to various aspects of their business tax climate. Pretty interesting stuff, especially if you are a prospective business owner considering your options on where you might consider setting up shop, and especially if you're not one of those people who can influence enough state politicians to specifically exempt their business from those various state taxes. Like the way the film industry does.

But, if you go by the Tax Foundation's online state business tax climate rankings, you can expect to do a lot of scrolling to find out how a particular type of tax for a given state ranks. For example, if your business is particularly affected by property taxes, you'll need to scroll down to find that New Mexico is the leading state in that category for 2008. But you'll also find that the state doesn't rank very well in other categories that may be important to you, so you may not be all that enchanted with the Enchantment State!

Repeat the exercise for the Number Two state, and then you can see where you might be in for more analysis than you really ought to have to do!

If you're making real world decisions based on these rankings, what you really need is for the data posted online to do more than just sit there. What you need to really start cooking is to make the data move. And that's where we've come in! We've taken the Tax Foundation's 2008 State Business Tax Climate rankings and put them in the dynamic table below. You can instantly sort the data according the various rankings by clicking the column headings: clicking once will rank the data from highest to lowest, clicking again will rank the data from lowest to highest.

And that's it! Our dynamic table is just sitting here waiting for you. Which state's business tax climate cuisine reigns supreme is entirely up to you!

| 2008 Tax Foundation State Tax Climate Rankings |

|---|

| State | Overall Rank | Corporate Tax Index Rank | Individual Income Tax Index Rank | Sales Tax Index Rank | Unemployment Insurance Tax Index Rank | Property Tax Index Rank |

|---|---|---|---|---|---|---|

| Alabama | 21 | 21 | 19 | 25 | 12 | 12 |

| Alaska | 4 | 26 | 1 | 5 | 47 | 22 |

| Arizona | 25 | 24 | 26 | 45 | 3 | 10 |

| Arkansas | 35 | 35 | 29 | 37 | 18 | 16 |

| California | 47 | 40 | 50 | 42 | 15 | 5 |

| Colorado | 13 | 15 | 13 | 11 | 20 | 15 |

| Connecticut | 38 | 17 | 18 | 30 | 19 | 50 |

| Delaware | 9 | 48 | 32 | 2 | 7 | 7 |

| Florida | 5 | 14 | 1 | 19 | 2 | 18 |

| Georgia | 20 | 6 | 24 | 16 | 22 | 33 |

| Hawaii | 22 | 9 | 43 | 17 | 23 | 4 |

| Idaho | 31 | 19 | 34 | 34 | 44 | 2 |

| Illinois | 28 | 29 | 12 | 32 | 42 | 40 |

| Indiana | 12 | 22 | 10 | 12 | 10 | 17 |

| Iowa | 45 | 45 | 45 | 20 | 37 | 31 |

| Kansas | 33 | 38 | 25 | 24 | 9 | 38 |

| Kentucky | 36 | 39 | 31 | 10 | 48 | 20 |

| Louisiana | 32 | 18 | 28 | 47 | 8 | 21 |

| Maine | 41 | 43 | 38 | 13 | 40 | 41 |

| Maryland | 24 | 7 | 37 | 7 | 30 | 39 |

| Massachusetts | 34 | 46 | 15 | 8 | 49 | 45 |

| Michigan | 29 | 49 | 14 | 14 | 45 | 25 |

| Minnesota | 42 | 44 | 39 | 40 | 39 | 19 |

| Mississippi | 18 | 8 | 16 | 35 | 5 | 32 |

| Missouri | 15 | 10 | 23 | 22 | 4 | 9 |

| Montana | 6 | 16 | 20 | 3 | 21 | 8 |

| Nebraska | 43 | 33 | 33 | 46 | 17 | 42 |

| Nevada | 3 | 1 | 1 | 43 | 41 | 13 |

| New Hampshire | 7 | 50 | 9 | 1 | 38 | 36 |

| New Jersey | 49 | 41 | 49 | 44 | 24 | 49 |

| New Mexico | 23 | 36 | 17 | 41 | 13 | 1 |

| New York | 48 | 23 | 41 | 49 | 46 | 43 |

| North Carolina | 40 | 25 | 44 | 39 | 6 | 34 |

| North Dakota | 30 | 27 | 36 | 29 | 26 | 6 |

| Ohio | 46 | 37 | 48 | 36 | 11 | 44 |

| Oklahoma | 19 | 13 | 22 | 31 | 1 | 24 |

| Oregon | 10 | 20 | 35 | 4 | 32 | 14 |

| Pennsylvania | 27 | 42 | 11 | 26 | 25 | 47 |

| Rhode Island | 50 | 34 | 47 | 33 | 50 | 48 |

| South Carolina | 26 | 11 | 27 | 18 | 43 | 29 |

| South Dakota | 2 | 1 | 1 | 38 | 33 | 11 |

| Tennessee | 16 | 12 | 8 | 48 | 31 | 35 |

| Texas | 8 | 47 | 7 | 28 | 14 | 27 |

| Utah | 17 | 5 | 30 | 27 | 28 | 3 |

| Vermont | 44 | 32 | 46 | 15 | 16 | 46 |

| Virginia | 14 | 4 | 21 | 6 | 29 | 23 |

| Washington | 11 | 31 | 1 | 50 | 36 | 28 |

| West Virginia | 37 | 28 | 40 | 21 | 35 | 26 |

| Wisconsin | 39 | 30 | 42 | 23 | 27 | 37 |

| Wyoming | 1 | 1 | 1 | 9 | 34 | 30 |

* Yes, we're fans of Iron Chef!

Just out of curiosity, have you ever considered just how many people it really takes to put one person at the right place at the right time with the right tools to do a job that needs to be done?

The most marvelous thing about the division of labor in the modern economy is that you normally never see them at all!

Photo above modified slightly from the version we found here.

Labels: economics, none really

Welcome to the Friday, July 25, 2008 edition of On the Moneyed Midways! Once again, we've surfed our way through the best of the business and money-related blog carnival of the past week to bring you the best of what we found on the moneyed midways!

Welcome to the Friday, July 25, 2008 edition of On the Moneyed Midways! Once again, we've surfed our way through the best of the business and money-related blog carnival of the past week to bring you the best of what we found on the moneyed midways!

We're pretty much spanning the full range of human economics this week, considering everything from what to do if you lose your job to how to lighten up those delicious summer beverages. Along the way, we find a better PowerPoint presentation, dip into the Florida real estate market and consider the state of banking stocks.

And then, there's even more! The best of what we found in the week that was await you below....

| On the Moneyed Midways for July 25, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Careers | How to File for Unemployment Insurance Benefits | Money Blue Book | Raymond provides a valuable primer on what unemployment insurance is, who pays for it, who qualifies for it and what you can expect if you find yourself unemployed through no fault of your own. |

| Carnival of Debt Reduction | Becoming Debt Free: Identifying the Why | frugaldad | Mr. Frugal turns philosophic in considering why becoming debt-free might be desirable - believe it or not, being debt-free isn't for everyone! |

| Carnival of Personal Finance | Money Lessons Learned from Famous Movies | The Red Stapler Chronicles | rutgerskevin identifies the hidden lessons about money that might be extracted from a number of unlikely Hollywood movies! |

| Carnival of Personal Finance | By the Numbers: Credit Scores and Car Insurance | Financial Ramblings | Absolutely essential reading! Sean shows number by number how your credit score drives your insurance rates! |

| Carnival of HR | PowerPoint - Visuals, Take 2 | Fortify Your Oasis | What's wrong with the way that typical PowerPoint presentation are put together? Rowan Manahan provides a 128 slide-long presentation that shows you (and won't put you to sleep!) |

| Carnival of Real Estate | Declining Home Prices | Tallahassee Real Estate | Joe Manausa shows the trends in Tallahassee, Florida housing prices the way we would! |

| Festival of Frugality | The Booze of Summer: A Quick and Dirty Guide to Lighter, Cheaper Drinks | Cheap Healthy Good | The Best Post of the Week, Anywhere! Yes, it's summer and we're always ready for a cool drink! Kris' post points the way to both fully refresh yourself and to fully enjoy the season! |

| Festival of Stocks | Banks that Are Not Wells Fargo (WFC) or US Bancorp (USB) Guilty Until Proven Innocent | College Analysts | James Cullen turns a suspicious eye on bank stocks, finding precious few to be excited about. |

| Money Hacks Carnival | 10 Reasons Why I Love ING Direct | Christian PF | If you've ever been intrigued by the higher interest rates offered by ING's savings products, Bob's post about his experiences in banking through them might well convince you it's time to set up a new account. |

| Money Hacks Carnival | People Who Like to "Split the Tab" Are No Longer My Friends | Budgets Are Sexy | Should "going Dutch" end a relationship? J. Money says that it can and that it should change it at the very least. |

| Carnival of Money Stories | Family Financial History | LivingAlmostLarge | What would you learn about money if you grew up in a cash-poor single parent household? What more might you need to learn? Absolutely essential reading! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

It occurs to us that there might be an ideal way for Americans to get around restrictive gun laws in places like Washington D.C., where even after losing big time in the U.S. Supreme Court, the city government is doing all it can to prevent law-abiding individuals from obtaining handguns to protect themselves.

It occurs to us that there might be an ideal way for Americans to get around restrictive gun laws in places like Washington D.C., where even after losing big time in the U.S. Supreme Court, the city government is doing all it can to prevent law-abiding individuals from obtaining handguns to protect themselves.

The answer for law-abiding individuals is to stop using handguns altogether and to instead exercise their right to defend themselves and their families from people who would do harm to them by packing heat. Real heat. They should leapfrog handgun technology altogether and go straight up the technological food chain and begin using rayguns for the job of personal self-defense.

Think that's entirely science fiction? Wired's Noah Schactman reports:

In June 2006, in tests at Sandia National Laboratories, ray gun researchers at Raytheon did something extraordinary. It had been accepted wisdom in the laser community that 100 kilowatts was the minimum power required for battlefield-strength blasters -- a level that hasn't been hit (yet). But in these tests, the Raytheon crew managed to zap a couple of mortar rounds, using a bundle of fiber lasers that only had 20 kilowatts of power. Not only that, it's beam quality was terrible: Spread out all over the place, instead of in a nice, tight spot. So how did they pull it off? It turns out that the laser's weakness -- its lousy beam quality -- was also its strength. By spreading out the laser's spot, the weapon has [sic] able to heat the mortar up -- and cause it to explode. Think of it like an explosive potato, left too long in a laser oven.

Now, think of encountering a felon, in your home, who is freely able to threaten you and your family with a gun just because your local government has put an extraordinary number of barriers in your way to lawfully getting a gun of your own to protect yourself. Now imagine if you had a working version of one of Dr. Grordbort's Manmelter 3600ZX Sub-atomic Disintegrator Pistols (pictured above). They're likely not covered by your local anti-gun ordinances and even more likely couldn't be without also banning a lot of laser technology already in widespread use, like those laser speed guns the police use for local government revenue enhancement. In our scenario, what happens next is the pretty much the same as what typically happens whenever people armed with inferior technology encounter those armed with superior technology: the people with the inferior technology cease to be a threat.

You might not even need to make them explode! Just the possibility of that outcome alone ought to dramatically increase the odds that they will either run away or give up. Just as if you hadn't been prevented from having an old-fashioned slug-throwing gun to defend yourself by those arcane and now unconstitutional anti-gun ordinances.

Sure, having a bullet-firing gun might deliver the same result, but you still have to admit that our suggestion is way cooler!

Labels: none really

Cali Ressler and Jody Thompson, the authors of Why Work Sucks and How to Fix It, recently stumbled across our tool that considers whether or not it makes sense to move closer to work and used it for evil.

Cali Ressler and Jody Thompson, the authors of Why Work Sucks and How to Fix It, recently stumbled across our tool that considers whether or not it makes sense to move closer to work and used it for evil.

Evil, that is, where the distrustful people* who run your company are concerned! After all, how can they adequately determine whether or not you are actually doing the work you are supposed to be doing unless you are continually monitored to ensure that you are doing it?

But with today's telecommunication technology and an ever-growing list of occupations that don't need to be continually done at a given location, not to mention the increased cost of getting from home to work and back each and every workday, shouldn't you be freed from the shackles binding you to the specific place you work?

In other words, why not telecommute? Or reschedule your commute to support an alternate work schedule? After all, working eight hours a day five days a week fifty weeks a year might not be totally necessary. What if something else works better for you? What if there is a better way to work?

Cali and Jody put it better than we can, as they consider the move by a number of businesses and governments to impose four-day work weeks for their employees:

While well-meaning politicians, corporate executives and school administrators begin exploring, and even mandating, "four-day workweeks" to fight the pain at the pump, we scratch our heads. Why not shift the work environment to one where physical presence, the quantity of hours one works, and the commute itself are rendered obsolete?

It’s time to start viewing office work as something we do, not related to a place we go.

Merely showing up at a job doesn’t deliver business results. People are showing up at their jobs today, and may or may not be getting anything done. A four-day workweek only sustains this system of time equating to productivity.

Yes, we agree that reducing your commute by one day may save some money, but let’s offer people the opportunity to experience some real savings – and for businesses to unleash the full potential of their employees.

That's the kind of evil we like! So much so that we've tweaked our original tool to focus purely on how beneficial it might be for you to alter how often you commute for work. All you need is to consider is your regular commuting costs and options, we'll find out how it affects your personal bottom line with the latest gas prices:

Normally, we'd share some insight that we discovered through using our tools, but in this case, Cali and Jody have already done the heavy lifting for us. Here's what they found in using our not-quite-as-optimized-to-consider-this-question tool (emphasis ours):

Final note: check out this nifty calculator that lets you figure out whether or not you should move closer to work in order to save money on commuting costs. You’re supposed to fiddle with the cost-of-the-new-house variable and the distance variable, but we played with the number of commuting days a week. Moving closer to work can make a difference... but only driving to an official physical office space two or three days a week saves you BIG.

Now that you know how big those savings are for you, don't you think it's time to get with your co-workers and add all your commuting savings together and really unleash some evil at your office?

* We won't name names, but you know who we mean. They are, after all, the same kind of people who require their staffs attend a neverending series of meetings!

Labels: business, gas consumption

First Trust's Brian Wesbury is predicting a remarkably positive GDP for the second quarter of 2008 (HT: Mark Perry):

Late next week the government will release initial estimates of real economic activity in the second quarter. Not long ago, in early April, when the quarter was just beginning, the consensus forecast for Q2 2008 real GDP growth was 0.0%, with as many economists predicting contraction as were predicting growth.

Now, three months later, the consensus is up to 2.2%. And no surprise - we are forecasting a 3% growth rate, more bullish than almost any other economist.

Here's what Wesbury anticipates will drive GDP to the high end of the forecasters' consensus:

Personal Consumption: We already have full consumption data for April and May as well as auto sales and retail sales for June. The only piece missing is June services. We estimate real consumption grew at a 2.0% annual rate in Q2. With consumption accounting for 70% of GDP, real PCE will contribute 1.4 points to real GDP growth (1.4 equals 70% of 2)."

Business Investment: Data through May show business investment in equipment and software was unchanged in Q2. However, business construction continued to boom, suggesting overall real business investment will grow at about a 6% annual rate in Q2. With business investment accounting for about 10% of GDP, this translates into 0.6 points for real GDP growth (0.6 equals 10% of 6).

Housing: Data on home building suggests a decline at about a 23% annual rate in Q2. Given that the sector makes up roughly 4% of GDP, this translates into a drag of 0.9 points on real GDP growth (0.9 equals 4% of 23).

Government: Federal defense spending and public construction at all levels of government were unusually strong, suggesting gov’t spending accounts for 0.5 points worth of real GDP rather than the 0.3 or 0.4 trend.

Trade: The inflation-adjusted trade deficit has been shrinking rapidly. Even assuming no additional improvement in June, net exports will add about 2.0 points to real GDP growth.

Inventories: We assume businesses around the country reduced stockpiles at an annual rate of $37 billion, the largest reduction since the 2001 recession," which Wesbury expects to alter real GDP by -0.6 points.

With the math laid out like this, getting to Wesbury's predicted GDP is just a matter of adding and subtracting these anticipated values. Here it is all laid out in formula form:

Real GDP = + 1.4 + 0.6 - 0.9 + 0.5 + 2.0 - 0.6 = +3.0

Not bad for this recession the major news media says we're in! Speaking of which, the next chart shows the probability that the U.S. is in recession today (calculated using data from one year ago!):

Meanwhile, Mark Perry sees a similar trend at work at Intrade's 2008 recession prediction market:

Odds of a 2008 U.S. recession have fallen to 17.4% on Intrade.com, from 70% in mid-April, and from about 33% just a week ago

Can there even be a recession if the growth rate of real GDP never turns negative? Perhaps there could be, given how badly far off the BEA's originally reported GDP figures were in 2000 from where they were later revised to be, which at the time, masked the extent to which the economy was sliding into recession during the course of that election year.

Who's to say that similar political considerations aren't skewing how the data is being reported today?

Labels: gdp, gdp forecast, recession forecast

Courtesy of TED and Arthur Benjamin:

HT: Craig Newmark

Want to impress your friends? Here are some mental multiplication tricks. And if you're really serious about wanting to beat a calculator, here's the definitive site for what you'll need to know!

Labels: none really

Welcome to the Friday, July 18, 2008 edition of On the Moneyed Midways! We seek out the top posts from each of the best of the past week's business and money-related blog carnivals and collect them here, your single destination for the best reading in the business and money-related blogosphere!

Welcome to the Friday, July 18, 2008 edition of On the Moneyed Midways! We seek out the top posts from each of the best of the past week's business and money-related blog carnivals and collect them here, your single destination for the best reading in the business and money-related blogosphere!

Quite simply, OMM reviews hundreds of posts contributed to blog carnivals every week to bring you the best of each. But more than that, we also identify The Best Post of the Week, Anywhere!, our designation of the post that combines some of the best writing with a highly engaging topic. Other posts that stand out from the pack earn the title of being Absolutely essential reading!

And regardless of these titles, all posts selected for OMM represent the best of the blog carnival where we found them! Speaking of which, the best posts of the week that was are awaiting you below....

| On the Moneyed Midways for July 18, 2008 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Careers | Creating a Portfolio Career | Slow Down Fast | What if, instead of one regular job, you worked a number of part-time jobs? David B. Bohl argues that you could find greater security and stability by doing just that! |

| Carnival of Debt Reduction | How Do I Sell My Stuff: Part I - Determining What You Can Sell | In Debt Because I Like Nice Things | Tired of the clutter in your life? If so, Twigger's post on how to identify things you can sell vs things you ought to just throw away might be pretty valuable! |

| Carnival of Personal Finance | Not-So-Slacker Insurance II: …And I Love My HSA | Blue Jeans Millionaire | The Best Post of the Week, Anywhere! Christine talks through how she chose between the different health care plans available through her work. |

| Carnival of Real Estate | How Far Would You Go to Show a Property? | VA Real Estate Talk | If you're a Realtor looking to make a deal, would you break and enter into a listed home for sale to show it to your clients? Cindy Jones explains a situation she encountered…. |

| Carnival of Trust | The More Meetings, the Less Trust | Slow Leadership | Did you ever wonder why you have so many meetings at work? Carmine Coyote answers that comes down to a lack of trust between people working at the company in Absolutely essential reading! |

| Cavalcade of Risk | Disability Ratings with a Heart of Darkness | Workers Comp Insider | Jon Coppelman tells a story of how political connections and extreme corruption work to undermine the businesses that insure against risk in Zimbabwe and make the country uninsurable. |

| Money Hacks Carnival | The Undeniable Pet Insurance | Value for Your Life | Where will the money come from for treatment if your pet falls ill or is injured? Veterinarian Amanda Milne outlines the ethics and options. |

| Carnival of Money Stories | Benefits of Working at a Fast Food Restaurant | Harvesting Dollars | Lots of snooty people look down on "fast-food" jobs for teenagers. Todd lists why they're essential to developing successful real-world business skills. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

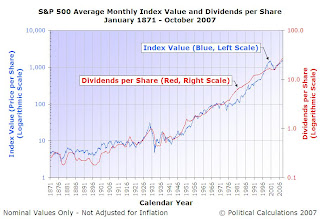

Lots of people have been pointing recently to the ten year rates of return for the various stock indices and observing: gosh, the market today is lower than it was ten years ago. We've lost a decade!

Lots of people have been pointing recently to the ten year rates of return for the various stock indices and observing: gosh, the market today is lower than it was ten years ago. We've lost a decade!

This is one of our pet peeves. The problem with using rates of return like this to evaluate stock market performance is that they're locked into the data at just two dates: the value of stocks at the beginning of the period and the value of stocks at the end of the period in question. This method of measuring market performance can work a lot of the time, but doesn't always give you a clear picture of what was going on in the stock market over the given interval.

For this kind of measure to be genuinely indicate the market conditions over the period you're looking at, you should be able to slightly shift the starting and end dates of when you're finding the rate of return without drastically changing the rate of return you get. (You can use this tool to do just that for the S&P 500!) If you do this and you get dramatically different numbers, that tells you that something significant was going on in the stock market at either the beginning of the period or at the end, or quite possibly both.

Our pet peeve in particular is that the people who do this sort of thing often omit the details behind what was going on in the stock market at the beginning or end of the period for which they are providing the rate of return, in our view, either through laziness or to intentionally mislead their readers (the example linked above is most likely laziness.)

The reason why this may be important to you is that the conditions of the stock market are something that you might want to know as an investor so you can factor into your investment decisions just how typically or atypically the stock market has been performing over the time in question. For example, if you knew we were in a stock market bubble (we're not), you might routinely set a number of stop loss orders at increasing levels to minimize any losses you might incur from when the bubble pops!

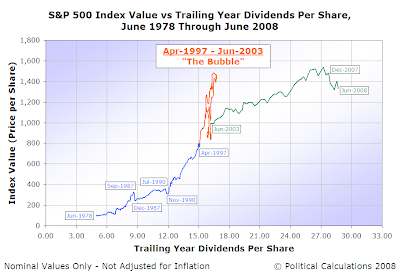

So how does that matter over these particular past ten years? Between April 1997 and June 2003, the stock market was passing through the disruptive event now known as the Dot-Com Bubble. The prices of stocks were highly inflated during this period and fully decoupled from the underlying fundamentals that have always driven their values. As a result, any comparison between stock prices then and now must note that the conditions at the beginning of these ten periods were highly atypical.

To see what we mean, here's a chart showing the period from December 1991 through June 2008 upon which we've indicated the average monthly value of the S&P 500 as of 15 July 2008 to show how it compares with stock prices over the period:

So, just how typical do you think the rates of return will be over ten year periods from April 1997 through June 2003?

If you said "not very," you're right!

Of course, there's nothing like more data to back up the point as to how atypical the stock market action was during this period, so this next chart shows the same data over the past 30 years from June 1978 through June 2008, highlighting some dates of interest:

Black October (September 1987-December 1987) and the pre-Gulf War dip (June 1990-December 1990) stand out, as well as perhaps today's market turmoil (beginning in January 2008), but in scale and scope, none compare to the Dot Com Bubble.

Just something to remember that when someone who ought to know better starts spouting off about how bad the last ten years have been for stocks!

Labels: SP 500, stock market

Once again, we've updated our signature tool The S&P 500 at Your Fingertips, with all the latest available data through June 2008. The chart below, which we've tweaked a bit from the version we showed late last week, shows where we're at and where things sit here at the midpoint of July:

![S&P 500 Average Monthly Index Value vs Trailing Year Dividends per Share, January 2008 through Present [15 July 2008]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhBJgMqGBOMLAzEIBRiSgOELB1CyLu09-lf5mHy5C7YPLZwp-aBZhjJmeqFPGOm40MuiocnzNvFYtm7cux6JtgDQOuNlf107VkAd0NkDHalU2W1nxTe4f7WB9VKkukmu2MQS0q2/s400/SP500-Average-Monthly-Index-Value-vs-Trailing-Year-Dividends-per-Share-Jan-2008-Present-15-July-2008.PNG)

Elsewhere, Tigerhawk has asked if the recent market action is a reaction by investors discounting the possibility of a likely Obama presidency (HT: Instapundit). The answer to that question is no, at least not yet. The trigger behind sharp market declines is, almost invariably, the risk of financially-distressed companies cutting their dividends to improve their balance sheets. Since changes in expected dividend payments in the future directly drive stock prices, when investors can reasonably expect that this will happen, stock prices anticipate this action by sinking lower.

How important are dividends to establishing the value of stocks? Consider this: even though the stock market initially rallied when the price of oil unexpectedly dropped by $6.44 per barrel to close at $138.74 on the news that President Bush rescinded an executive order prohibiting drilling on the U.S. portion of the North American outer continental shelf yesterday, stocks still managed to sink as investors are still uncertain as to when and how much a number of companies (see below) will be taking actions to cut their dividends.

The Action Through June 2008

In moving from May to June 2008, stock prices declined sharply with respect to their underlying dividends per share, suggesting a period of increased distress was approaching. Standard and Poor's Howard Silverblatt, writing in the June 2008 S&P 500 MarketAttributes Snapshot (generic link here - we're not aware of a permanent link), noted the developing situation:

As concern over earnings reemerged, so did concern over dividends. June’s dividend increases picked up, but the month also included decreases by FITB and DividendAristocrat KEY. Year-to-date, there have been 20 dividend decreases with 17 being in the Financials. For the month, 16 issues increased, none initiated, 2 decreased and 0 suspensions, versus 12 increases, 0 initiations, 1 decrease, 0 suspensions for the same period in 2007 and 17 increases, 0 initiations, 0 decreases, 0 suspensions for May 2006. Year-to-date, increases are down 161 versus 167 for 2007, with decreases up 20 versus 4 in 2007.

Still S&P has not altered their forecast for the S&P 500's trailing year dividends per share for 2008, which they still anticipate will be $30.30. We would however anticipate the level of dividends for 2008 will come in below this figure, as a number of large companies in the financial sector will likely be cutting their dividends to help improve their balance sheets in the very near future, much as General Motors did yesterday.

The following table illustrates the ten most likely candidates for the dividend chopping block (with GM included for reference), ranked according to their dividend yield given the values of their individual stocks and their estimated dividend payments per share for the next year as of 15 July 2008:

| S&P 500 Highest Dividend Yield Stocks on 15 July 2008 | |||||

|---|---|---|---|---|---|

| Company | Ticker | Sector - Industry | Price [15 July 2008] |

Estimated Dividend [For the next year] |

Dividend Yield [%] |

| American Capital Strategies | ACAS | Financial - Closed-End Fund/Debt | 17.80 | 4.39 | 24.66 |

| Regions Financial | RF | Financial - Banking | 6.88 | 1.52 | 22.09 |

| Wachovia | WB | Financial - Banking | 9.08 | 1.50 | 16.52 |

| Comerica | CMA | Financial - Banking | 20.89 | 2.98 | 14.27 |

| Fannie Mae | FNM | Financial - Mortgage Investment | 7.07 | 1.00 | 14.14 |

| Bank of America | BAC | Financial - Banking | 18.52 | 2.60 | 14.04 |

| SunTrust Banks | STI | Financial - Banking | 26.98 | 3.12 | 11.56 |

| Huntington Bancshares | HBAN | Financial - Banking | 4.64 | 0.53 | 11.42 |

| Marshall & Ilsley | MI | Financial - Banking | 11.59 | 1.30 | 11.22 |

| General Motors | GM | Consumer Goods - Auto Manufacturer | 9.84 | 1.00 | 10.16 |

| Gannett | GCI | Services - Newspaper Publishing | 17.35 | 1.76 | 10.14 |

Until the erosion in dividends ends, we're afraid that the S&P 500 and other major stock indices will not be going up anytime soon. We would anticipate that the carnage in the market will continue until the powerhouse financials dragging the indices down get serious about building up their balance sheets and pull the trigger on dividend cuts. Then, and only then, will investors regain confidence in these companies.

Labels: dividends, SP 500, stock market

As promised, here's our operational definition of an economic bubble:

An economic bubble exists whenever the price of an asset that may be freely exchanged in a well-established market first soars then plummets over a sustained period of time at rates that are decoupled from the rate of growth of the income that might be realized from owning or holding the asset.

Here are a couple of examples of our definition at work:

- For a stock market, a bubble can be said to exist when the price of stocks changes at a rate that is not coupled with the growth rate of dividends, the payments investors might receive from holding stocks. An example of a bubble occurred in the U.S. stock market from April 1997 and lasted until June 2003. Prices in the U.S. stock market were well-coupled during the periods preceding the bubble and afterward.

Regular readers of Political Calculations will recognize the following chart illustrating the Dot-Com stock market bubble:

- For a housing market, a bubble can be said to exist when the price of houses grows at a rate that is not coupled with the growth rate of rent, the payments owners might receive from owning housing properties. Our example of a bubble in the U.S. housing market is incomplete, as the plummeting phase of the recent housing bubble is still underway. Here however is the best evidence that a housing bubble is underway, the chart on the left is taken from Robert Shiller's 2007 Jackson Hole paper Understanding Recent Trends in House Prices and Home Ownership, the chart on the right is one we've presented previously, showing the S&P 500's index value and dividends per share in a similar format to what Shiller shows:

To recognize that a bubble exists in housing, we should observe the similarity between the relative rise of housing prices with respect to rent to that of the value of the S&P 500 index with respect to the index' dividends per share for the period that we've identified for the Dot-Com bubble (in particular, where we've pointed to the Index Value in the chart!)

Side Note: We've found that the best way to visualize the magnitude of an economic bubble is to plot the price of the asset against the corresponding dividend or rent income taken at different times, but unfortunately, we don't have access to Shiller's housing data to better illustrate the point, so this comparison will have to do for now.

Applying this definition gets trickier where non-renewable commodities like oil are concerned. After all, oil is something that is consumed - there is really no way that you can rent oil to use for just a little while then give the asset back to the owner! Still, there has to be some kind of stream of payments related to the production of oil whose value should be expected to increase in near lockstep with the price of oil when the price is driven by fundamental supply and demand impulses, and would not if the growth rate in the price of oil is decoupled from them. The best we could figure would be oil royalties, so here's how we would put it in terms of our operational definition of an economic bubble:

- For the oil commodity market, a bubble can be said to exist when the price of oil grows at a rate that is not coupled with the growth rate of oil royalties, the payments the owner of a recoverable oil-producing asset might receive from oil extractors.

What we don't have to check this latter example is data related to the value of oil royalty payments over time. If there's anyone out there who does have that kind of data, plot it against the price of a barrel of oil over time and see if anything emerges!

Speaking of things emerging, we can also now more formally define when order exists in economic markets:

Order exists in a market whenever the change in the price of assets in the market are closely coupled with the change in the income that might be realized from owning or holding the assets, within a band of approximately normal variation about a central tendency.

And now market disorder:

Disorder exists in a market whenever the change in the price of assets in the market is not coupled with the change in the income that might be realized from owning or holding the assets within a band of approximately normal variation about a central tendency that would describe the relationship between the two when order exists in the market.

Finally, let's recognize that bubbles are not the only kind of disorder that can occur in a market:

A disruptive event may be said to be taking place whenever a significant change in the price of assets in the market is not coupled with the change in the income that might be realized from owning or holding the assets over a limited period of time.

An economic bubble is an example of a disruptive event, as are shifts in the equilibrium that exists between prices and ownership-derived realizable income, such as market crashes or stable bull markets.

Labels: dividends, economics, SP 500, stock market

Writing at PhysOrg, Lisa Zyga reports on the work of researchers that suggests that today's spike in oil prices is largely based upon the actions of speculators rather than changes in currency valuations or fundamental issues of supply and demand. Here's the lede:

Since 2003, worldwide oil prices have quadrupled. According to a new study, the price of oil is rising at a faster-than-exponential rate, and cannot be sustained. In other words, we’re in the midst of an oil bubble, say researchers Didier Sornette and Ryan Woodard of ETH Zurich in Switzerland and Wei-Xing Zhou of the East China University of Science and Technology in Shanghai, China.

By analyzing oil prices over the past four years, the researchers have demonstrated more support for the hypothesis that the recent oil price run-up has less to do with supply-demand interplay and more to do with speculation.

Here's how the team of researchers came to this conclusion:

In their analysis, the team gathered data on oil prices since 2005 in US dollars, euros, and other major currencies (to confirm that the results are not a consequence of the weakening of the US dollar). They also examined worldwide oil supply and demand data, specifically investigating the extent of increased demand from emerging markets such as China and India.

Then, the researchers analyzed this data using a method that Sornette’s group started to develop in 1996 that identifies bubbles as "transient superexponential regimes" – basically, areas of rapid growth that occur due to a source of positive feedback within the system. The scientists looked at the data in the context of three different models, and all three models revealed the existence of a “log-periodic power law,” in mathematical terms – in other words, a bubble. In economic terms, the researchers explain, a bubble refers to a situation in which expectations of future price increases cause prices to temporarily rise without justification from fundamental valuation.

As we would interpret it, a "transient superexponential regime" is really a kind of resonance phenomenon. Like the sound produced by a tuning fork being struck at just the right frequency, a bubble results when the individual components of a system (in this case, the world's oil markets), become super-excited or amplified as the result of simultaneous feedback (keeping with the sound metaphor, let's call this "market buzz") generated by other participants in the market (traders, investors), which then reinforces the signal being sent by the original sources, and even amplifies it as new participants enter the resonating market.

As we would interpret it, a "transient superexponential regime" is really a kind of resonance phenomenon. Like the sound produced by a tuning fork being struck at just the right frequency, a bubble results when the individual components of a system (in this case, the world's oil markets), become super-excited or amplified as the result of simultaneous feedback (keeping with the sound metaphor, let's call this "market buzz") generated by other participants in the market (traders, investors), which then reinforces the signal being sent by the original sources, and even amplifies it as new participants enter the resonating market.

In this super-excited state, even small perturbations can produce very large effects (such as significant spikes in prices) as the system accumulates increasing amounts of energy (additional money from market participants). The reason this occurs is because when objects (market participants) are in resonance with one another, they exchange energy (information) with each other very efficiently but only interact weakly with extraneous sources of energy in their environment (say, information related to underlying supply-and-demand fundamentals that normally govern the market). As a result, in this example, amplified prices detach from their established relationship with those underlying market fundamentals, leaving us with what we call a bubble.

Eventually, extraneous energy (information) successfully enters into the system (the bubble market) and the state of resonance ends (the market crashes).

For us, what we find interesting is that no-one would seem to have a good operational definition of just what a bubble is:

“The most fundamental difficulties [in trying to describe oil prices] lie in the operational definition of a ‘bubble,’” Sornette told PhysOrg.com. “There is no consensus. One standard definition is ‘exponential growth of price.’ But exponential growth of price is normal in economics, because it just corresponds to a constant growth rate. Our definition is ‘faster-than-exponential' growth of the price, which is necessarily unsustainable.

We have what we think is a good working operational definition a bubble, which we'll present in the very near future.

In the meantime, we'll leave you with what the researchers see ahead in the oil market:

“I expect rather soon some calming with a correction of the price,” Sornette said when asked about his prediction of future oil prices. “But it seems that, for the medium term, one has to be bullish on oil.”

More Information

Here's the reference for the researchers' article:

Sornette, D.; Woodard, R.; and Zhou, W.-X. “The 2006-2008 Oil Bubble and Beyond.” Arxiv:0806.1170v2. 13 Jun 2008. Submitted to Physica A.

A PDF version is available here.

Labels: economics

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.