Welcome to our regularly scheduled, Friday, February 29, 2009 edition of On the Moneyed Midways, where today, we're actually posting the newest edition of our money-and-business-related blog carnival review on schedule!

Welcome to our regularly scheduled, Friday, February 29, 2009 edition of On the Moneyed Midways, where today, we're actually posting the newest edition of our money-and-business-related blog carnival review on schedule!

Yes, the last edition was horribly late. Worse, there was a real lack of really good insights, as we only found one post that was a contender for being The Best Post of the Week, Anywhere! Normally, we'll find at least one or two others in any given week, which we identify as Absolutely essential reading!, that were in the running for the title.

But not last week. And then, as if to show that maybe the business and money-obsessed end of the blogosphere was just taking the previous week off, we've found no fewer than four really outstanding posts this week, and even the ones that we didn't identify as being a top post are also well worth your time!

Those posts, and the best of the week that was, await you below....

| On the Moneyed Midways for February 22, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Ohhh How I Love Me Some Taxes!!! Just Got 'Em Back… | Budgets are Sexy | J. Money is rolling in his own, well, money after Uncle Sam was kind enough to give what he overpaid the government back. Here, he discusses where it's all going to end up! |

| Carnival of Personal Finance | Millionaire Bag Lady | The Strump | Absolutely essential reading! The Strump tells of the shopping experience of an extremely well-to-do, yet very modest appearing, woman at an upscale retailer, where snobbery spiked a significant sale opportunity. |

| Carnival of Real Estate | The 3 People Principle | Agent Genius | Ken Brand champions the power of networking to turn up prospects looking to buy or sell houses during tough times. |

| Cavalcade of Risk | A Tale of Two Reports. Commonwealth Fund and Milliman | Disease Management Care Blog | Jaan Sidorov looks at two reports considering how health care costs can be reduced. One is a retread of the kind of nationalized health care proposals being crowed about in Washington DC, the other is the product of actuaries who find opportunities for savings based on what actually has been shown to work. The Best Post of the Week, Anywhere! |

| Carnival of the Capitalists | Why Good Managers Make Bad Decisions | Three Star Leadership | Wally Bock adds his voice to a discussion between Erin White and Sydney Finkelstein on what leads otherwise smart managers to do dumb things. Absolutely essential reading! |

| Carnival of the Capitalists | 50 Funniest Short Job Descriptions Ever | JobMob | Scott Adams of Dilbert blog asked his readers to provide a one sentence description of their job. The results are job descriptions for the age of Twitter! |

| Festival of Frugality | Reduce Your Monthly Outgoings by Going Down the Gym | Find Financial Freedom | Tristan relates the story of an acquaintance who is using their gym membership as a tool for lowering their household expenses. |

| Festival of Stocks | American Italian Pasta: A Strong Stock Today | The Iconoclast Investor | Mike Cintolo is very impressed by the financial prospects and stock performance of the largest pasta maker in the U.S., American Italian Pasta (AIPC). |

| Money Hacks Carnival | An Example of What I've Been Talking About | Free Money Finance | You know those people who take out ginormous student loans to go into fields that have no significant earnings potential? FMF knows of one and uses the story of their stupidity to illustrate why your debt needs to match your realistic income earning potential. Absolutely essential reading. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

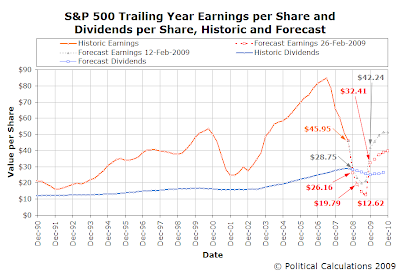

Unfortunately, the chart was based on the data available to us back on 12 February 2009 - the situation we showed then, shall we say, changed quite a bit. The forecast has gotten a lot worse and, in our own terminology, the earnings bucket has gotten deeper.

So, in the interest of mapping the change in investor expectations of corporate earnings over time, we're presenting our updated chart with all the data available to us as of this writing on 26 February 2009 (click the image to the right for a full-size version.)

In the chart above, we've shown how forecast earnings per share for the S&P 500 has changed since we last looked at where they were at as of 12 February 2009. And yes, that's correct - the outlook for S&P 500 earnings has changed that much in the past two weeks.

Originally, instead of venturing into how inflation expectations appear to affect stock prices, we were just going to give a rundown of the significant milestones we observed in our chart showing the relationship between stock prices and trailing year dividends per share during the years from 1976 into 1981. So, for the sake of filling in our historical record, that's what we'll do today!

Here's that chart again:

Now for the significance of the indicated dates, for which we found the Timelines of History for the years in question to be especially valuable, along with the BLS' inflation data and the monthly stock market data for the S&P 500 that we've previously documented:

| Date | Event |

|---|---|

| January 1976 | The last month of the preceding period of disorder in the stock market. Our next backward step through history will consider this period. |

| February 1976 | Dividends per share for the S&P 500 resumes positive growth, slowly at first, then faster as the U.S. economy more fully recovered from the recession that officially ended in March 1975 and especially as the rate of inflation in the U.S. decelerated from 6.7% in January 1976 to 5.0% in December 1976. |

| July 1976 | The S&P 500 peaks for the year with an average value of 104.44 for July 1976. Jimmy Carter becomes the Democratic Party's presidential nominee. In August 1976, weakened incumbent President Gerald Ford narrowly wins over Ronald Reagan for the Republican nomination. |

| January 1977 | Jimmy Carter is sworn in as the 39th President of the United States. The S&P 500 marks its high point for the year with an average 103.80 for the month of January, as the new administration institutes highly inflationary monetary and big spending fiscal policies. The annual rate of inflation booms upward from 5.2% in January 1977 to 7.0% in April 1977 before ranging between 6.2% and 6.8% for the next year. |

| July 1977 | Public perceptions of increasing social disorder in the U.S. are increased as a 25-hour power blackout affecting 9 million residents of New York City's metropolitan area, as looters rampaged in the city after lightning in upstate New York incapacitated the power grid. President Carter amplified those perceptions by equating criminal looting with the nation's unemployment situation on 22 July 1977. Stock values began a long downward march from the average level of 101.20 achieved in the month, even as dividends per share grow. |

| March 1978 to April 1980 | The S&P 500 bottoms out at 88.82. Inflation begins skyrocketing upward, beginning at 6.4% in March 1978 and peaking at 14.6% in April 1980. The gains in stock prices are largely an illusion, as they're being buoyed up by the effects of hyperinflation during this period. Here, an investment in the S&P 500 launched in March 1978 and terminated in April 1980 would, instead of growing at an annualized rate of 7.37% in nominal terms, really represent a loss of 4.54% when adjusting for the effects of those elevated levels of inflation. |

| August 1978 | The S&P 500 briefly peaks for two months with an average value of 103.90. |

| February-March 1980 | Stock prices plummet more than two standard deviations, which we've found to be an early indication that the order that we have identifed in the stock market is breaking down. This event occurred as the 1979 energy crisis neared its peak as the price of a barrel of crude oil rose to $39.50 (in 1980 US Dollars), its all-time highest level in inflation-adjusted terms until 7 March 2008. |

| April 1980 - November 1980 | The last downtick before a period of disorder in the market began. Here, as inflation peaked, it began to subside as the Federal Reserve under Paul Volcker implements much tighter controls on the U.S. money supply, with the bank prime lending rate reaching a level of 20% and demonstrating a willingness to hold it there, finally establishing the Federal Reserve's credibility in the eyes of investors that it was truly committed to subduing runaway inflation. Stock prices begin a rapid rise, going from 103.00 to 135.00 by November 1980. |

| August 1981-September 1981 | Stock prices dive as a major recession begins to take hold in the U.S. economy, as the Federal Reserve's continuing effort to decisively bring inflation under control has costs. Stock prices range within a narrow band between 109 and 123 until August 1982 when a new long-running bull market began. |

How much do investor expectations of increasing inflation affect the growth of stock prices?

That's the question we're introducing today, as we focus on the stagflationary era of U.S. economic history as we continue our backward march through time in considering the history of the stock market through the lens of the analytical tools provided to us from the world of modern industrial quality control.

Here is our "control chart" of the order that appears to have existed in the stock market from February 1976 through April 1980, followed by a period of disorder running until September 1981:

In the chart above, we see that the period of "order" is one in which stock prices grew at a very slow rate, as the exponent in our modeled equation falls between a value of 0 and 1. What's more, we see that stock prices often declined during this period even as dividends per share rose, which contradicts the fundamental relationship that we've found exists between the two.

Before we go any farther though, this isn't the only time we've seen our exponent, the price-dividend growth ratio, fall between the values of 0 and 1. We've seen that previously for the period of order which existed between June 2003 and December 2007:

With a price-dividend growth rate ratio of 0.7568, we confirm that the rate of growth of stock prices from June 2003 through December 2007 was much stronger than the nearly flat 0.0595 recorded for the period between February 1976 and April 1980. Both periods however fall well short of the price-dividend growth ratios that exceed a level of 1.0 that we've observed for sustained periods of robust growth in stock prices.

So, we have a bit of a puzzle. What could account for both the less than robust growth in stock prices for both 1976 through 1980 and 2003 through 2007, while also explaining why the rate of growth of stock prices between 1976 and 1980 is so much less than that we find between 2003 and 2007?

We don't know for sure, but we think that both the sameness and the differences we see in both these periods may be accounted for by what investors expected would occur with the rate of inflation in the U.S. economy. Let's take a look at the annualized rate of inflation from 1976 through 2007, as measured by changes in the Consumer Price Index for All Urban Consumers (CPI-U), to see what was going on throughout these periods:

In this chart, we've indicated three periods in which the rate of inflation was consistently rising over periods of several years (we've marked the period between 1987 and 1990 for future reference since we're focusing more on the periods between 1976 through 1980 and 2003 through 2007 in this post.) Visually comparing the slopes of our two primary periods of interest, we see that investors were seeing inflation consistently rise throughout the two periods below with price-dividend growth ratios below a level of one.

What's more, we see that the relative steepness of the slopes we observe in the rate of growth of inflation would appear to be negatively correlated with the value of the price dividend growth ratio observed in both periods. Here, we suspect that the more steeply inflation rises, the lower our observed price-dividend growth ratio will be, as investors expecting higher rates of inflation would tend to bid stock prices downward, even as dividends per share rise.

This is a relationship that we'll be revisiting as we continue to march backward in time with our analysis of stock prices with respect to their trailing year dividends per share. Right now, we just don't have enough data points to make a firm conclusion, although the influence of investor expectations for inflation might make for a compelling explanation for differences we observe in the rate of growth of stock prices over time that aren't directly driven by the rate of growth of dividends per share.

Labels: dividends, inflation, SP 500, stock market

We're fans of irony. And you really have to have a fine appreciation for irony to really appreciate the context of two events occurring within 24 hours of one another.

We're fans of irony. And you really have to have a fine appreciation for irony to really appreciate the context of two events occurring within 24 hours of one another.

First, the stock market dove on Monday, 23 February 2009, as evidenced by a 36.72 point decline in the S&P 500 to 743.33, a drop of 3.5% from the level of the previous trading day's close of 770.05. This change was primarily driven by one event: the anticipation of JP Morgan Chase's slashing of its dividend per share from $0.38 per quarter to $0.05 per quarter, a nearly 87% cut. Taken annually, that's a decline from $1.52 per share to $0.20.

This single action had an immediate impact upon the stock market as JP Morgan Chase is one of the largest companies by market capitalization in the S&P 500 index. As of 23 February, the percentage component weight of the company's stock within the index was 1.12%, which means that any change in its dividend payout that would affect its stock prices would have a very pronounced effect upon the market. And as we saw yesterday, it certainly did.

Now, here's where the irony comes into play. Today, the day after JP Morgan Chase's announced dividend cut precipitated a large drop in the value of the S&P 500, JP Morgan Chase analyst Thomas Lee announced that he expects the S&P 500 will rise by 8% in value in the short term:

Feb 24 (Reuters) - The S&P 500 index .SPX could rise as much as 8 percent in the near term, according to a JP Morgan Securities analyst who believes the recent sell off in the index owes more to a capitulation by investors than fears of nationalization of banks.

Analyst Thomas Lee set a "trading buy" rating and shot-term target of 800 on the index, with a stop-loss at 725.

For full disclosure, we don't disagree with Thomas Lee's assessment, but we certainly appreciate the irony of JP Morgan Chase's analyst anticipating the direct reversal resulting from the outcome of JP Morgan Chase's own actions!

Speaking of which, there hasn't been enough consideration of why JP Morgan Chase, which is considered to be one of the strongest banks today, cut its dividend by so much on 23 February 2009 (emphasis ours):

JPMorgan said its decision to lower its quarterly dividend to 5 cents per share from 38 cents will save $5 billion of common equity a year. It hopes the lowered payout will help it pay back the $25 billion of capital it got in October from the government's Troubled Asset Relief Program faster.

"Extraordinary times must call for extraordinary measures," Chief Executive Jamie Dimon said on a conference call. He said JPMorgan was "not asked by anybody" to cut the payout, but did so out of a "normal abundance of caution."

Shares of JPMorgan, a Dow Jones industrial average (.DJI) component, rose $1.08 to $20.59 after-hours, after falling 39 cents during regular trading. The New York-based lender announced the dividend cut after U.S. markets closed.

"I will accept a lower dividend if they are able to repay the government faster," said Chris Armbruster, senior analyst at Al Frank Asset Management in Laguna Beach, California, which owns JPMorgan shares. "The sooner they get out from that, the better."

This is nothing less than a major vote of no-confidence in the direction of the government's current efforts to bail out the financial sector of the U.S. economy.

Labels: dividends, SP 500, stock market

There are few things we feel are more insufferable on Earth than watching the annual Academy Awards telecast each year, so rather than put ourselves through the ordeal, we instead ask and answer a different question related to the Oscars and the movie business each year, which we find to be a more entertaining experience. Previously, we've asked if Academy Awards wins equate to big box office returns (not necessarily) or boost the box office performance of nominated films (they do!).

There are few things we feel are more insufferable on Earth than watching the annual Academy Awards telecast each year, so rather than put ourselves through the ordeal, we instead ask and answer a different question related to the Oscars and the movie business each year, which we find to be a more entertaining experience. Previously, we've asked if Academy Awards wins equate to big box office returns (not necessarily) or boost the box office performance of nominated films (they do!).

This year, we wondered if the least popular Oscar-nominated films actually deliver better box office returns than the worst movies made each year. In other words, how does the perceived quality of film-making affect the amount of money a movie makes?

To find out, we compared the U.S. box office returns for the worst movies of each year, as determined by whether or not the film "won" the Golden Razzie for Worst Picture with the least popular Oscar-nominated film for each year, as measured by its U.S. box office totals. We chose this method as being the closest we could get to an apples-to-apples comparison between "high quality" and "low quality" movies, since we would hypothesize that movie-goers would be less likely to want to pay the high cost of a movie ticket to see a worse movie. The dynamic table below summarizes what we found for each year since 1980, the first year in which the "Golden Razzie" was awarded:

| Box Office for Worst Movies and Least Popular Best Movies, 1980-2009 |

|---|

| Year | Winner of Golden Razzie Award for Worst Picture | Razzie Winner Box Office | Lowest Box Office Academy Award Nominee | Oscar Nominee Box Office |

|---|---|---|---|---|

| 1980 | Can't Stop the Music | $2,000,000 | Tess | $20,093,330 |

| 1981 | Mommie Dearest | $17,988,509 | Atlantic City | $12,729,675 |

| 1982 | Inchon | $5,200,986 | Missing | $14,000,000 |

| 1983 | The Lonely Lady | $1,223,220 | The Dresser | $5,310,748 |

| 1984 | Bolero | $8,914,881 | A Soldier's Story | $21,821,347 |

| 1985 | Rambo: First Blood Part II | $150,415,432 | Kiss of the Spider Woman | $17,005,229 |

| 1986 | Howard the Duck [1] | $14,964,638 | The Mission | $17,218,023 |

| 1987 | Leonard Part 6 | $4,916,871 | Hope and Glory | $10,021,120 |

| 1988 | Cocktail | $78,222,753 | The Accidental Tourist | $32,632,093 |

| 1989 | Star Trek V: The Final Frontier | $51,210,049 | My Left Foot | $14,743,391 |

| 1990 | The Adventures of Ford Fairlane [2] | $21,413,502 | Goodfellas | $46,836,394 |

| 1991 | Hudson Hawk | $17,218,080 | Bugsy | $49,114,016 |

| 1992 | Shining Through | $21,733,781 | Howards End | $25,966,555 |

| 1993 | Indecent Proposal | $106,614,100 | The Remains of the Day | $23,237,911 |

| 1994 | Color of Night | $19,721,814 | Quiz Show | $24,822,619 |

| 1995 | Showgirls | $20,302,961 | Il Postino | $21,848,932 |

| 1996 | Striptease | $32,758,418 | Secrets and Lies | $13,417,292 |

| 1997 | The Postman | $17,593,391 | The Full Monty | $45,950,122 |

| 1998 | An Alan Smithee Film: Burn Hollywood Burn | $43,904 | Elizabeth | $30,082,699 |

| 1999 | Wild Wild West | $113,745,408 | The Insider | $29,089,912 |

| 2000 | Battlefield Earth | $21,471,685 | Chocolat | $71,509,363 |

| 2001 | Freddy Got Fingered | $14,249,005 | In the Bedroom | $35,960,604 |

| 2002 | Swept Away | $598,645 | The Pianist | $32,572,577 |

| 2003 | Gigli | $6,068,735 | Lost in Translation | $44,585,453 |

| 2004 | Catwoman | $40,198,710 | Finding Neverland | $51,680,613 |

| 2005 | Dirty Love | $35,657 | Capote | $28,750,530 |

| 2006 | Basic Instinct 2 | $5,851,188 | Letters from Iwo Jima | $13,756,082 |

| 2007 | I Know Who Killed Me | $7,233,485 | There Will Be Blood | $40,222,514 |

| 2008 | The Love Guru | $32,074,182 | Frost/Nixon [3] | $17,411,000 |

[1] Tied with Under the Cherry Moon ($10,904,429)

[2] Tied with Ghosts Can't Do It (Box Office Not Available)

[3] Data Incomplete - Still in Release

In simply comparing the box office returns for each, we found that the worst movie of each year typically performed worse at the box office than the least popular Academy Award nominated film, with the least popular "higher quality" film outdrawing the "lower quality" movie some 21 times out of a possible 29, or 72.4% of the time.

So you would think that Hollywood would have a powerful incentive to make better movies, right?

Not so fast! Things got really interesting when we ran the basic statistics for each. We've presented the mean and standard deviation for the movies we considered in the following table:

| Basic Statistics for Worst Movies and Least Popular Best Movies, 1980-2009 | ||

|---|---|---|

| Movie "Quality" | Average Box Office | Standard Deviation |

| "Worst" Picture of Year | $28,758,069 | $37,423,387 |

| Least Popular "Best" Picture of Year | $28,013,453 | $15,231,718 |

What we find is that average of how much revenue each kind of movie generates at the box office is nearly identical. What's very different though is the measure of variance (the standard deviation) from year to year for the "higher quality" and "lower quality" movies.

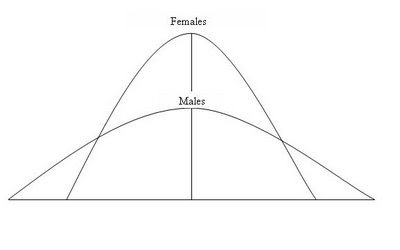

Here, we see that "lower quality" movies really vary a lot in their box office totals from year to year, while "higher quality" movies are much more consistent in their box office totals. And that difference turns out to be very similar to the difference documented between how men and women perform academically!

Here, recent research shows that male students tend to have much greater variation in their academic test scores than female students, with males more likely to either score very well or very poorly than their female counterparts, even though the average for each is nearly identical. We've borrowed the following chart from Mark Perry to visualize the difference:

Where movie-making is concerned, even though the box office return statistics for the least-popular "high quality" movies indicate they provide much more consistent returns, we strongly suspect the relative cost of production of "higher quality" films is greater than that for "lower quality" films. The relative lower cost of production combined with the variation in the box office performance of bad movies actually encourages their production, since they offer the potential for a greater return with much less investment.

And that's how men are like bad movies and also why the steady stream of crappy movies from Hollywood is unlikely to change anytime soon!

Labels: academy awards, box office

Welcome to this very rare Sunday, February 22, 2009 edition of On the Moneyed Midways, where today, we're finally catching up to the best of the past week's money and business-related blog carnivals!

Welcome to this very rare Sunday, February 22, 2009 edition of On the Moneyed Midways, where today, we're finally catching up to the best of the past week's money and business-related blog carnivals!

There's no excuse - we're late posting this week's edition and that's all there is to it! So late, in fact, that we'll just go straight to it: The best posts found in the best of the week's business and money-related blog carnivals will be delayed no more!...

| On the Moneyed Midways for February 22, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | How to Strong Arm Your Way to a Better Deal | Bargaineering | Want lower cable bills? How about Internet service? Or a cell phone plan? Jim describes how to arm yourself for negotiating the best prices with your service providers. |

| Carnival of HR | Laying Down the Law on Executive Compensation | i4CP Productivity Blog | David Wentworth considers whether the $500,000 cap on CEO pay for government-bailout companies is just for show and wonders what effects it will have. |

| Carnival of Personal Finance | Signed Up for a Credit Card to Get a Free Sandwich | The Better Credit Blog | Ryan identifies the hidden cost of a free lunch in answering a question from a college student who ran his credit report and found that he had two credit cards open under his name - one of which he uses, the other because he filled out a form for a promotion and got a free sandwich. |

| Carnival of Real Estate | All Mortgages Are Now Assumable | Luxury Home Digest | Roberta Murphy makes a pitch to become the U.S. Mortgage Czar with a suggestion for how banks could deal with their "toxic" real estate assets. |

| Carnival of the Capitalists | A Failure of Nerve | Coyote Blog | The Best Post of the Week, Anywhere! Warren Meyer makes an outstanding argument in favor of more bankruptcies now as a way to accelerate the U.S. economy out of recession! |

| Festival of Frugality | Wife Swap and Couponing Gone Wrong | Prime Time Money | ABC's reality show "Wife Swap" provides the basis for PT's analysis of what can go wrong for both your pocketbook and your family when you focus too much on getting better deals through clipping coupons! |

| Carnival of Taxes | Updated for 2008 Taxes: Turning a $57,000 Salary Into a Zero Tax Liability | Wisdom from Wenchypoo's Mental Wastebasket | Wenchy has been revisiting some of her more classic advice, this time retelling the story of how one taxpayer made all his tax liability disapper, legally! |

| Money Hacks Carnival | Stupid Advice from a Payday Lender Courtesy of Google News | Payday Loans Review | David delivers a fun fisking of a "news" article that offers some pretty absurd financial advice. |

| Carnival of Government and Money | How Many Mustangs Could the $800 Billion Stimulus Buy? | Richer by the Day | Mike breaks down the spending of the stimulus package by how many Mustangs (from toy cars to collectible editions) could buy! |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

We're coming to the conclusion that a lot of people have the wrong idea about chaos. For example, if you ask someone if the stock market is a pretty chaotic place these days, they'll say it is and what's more, we'll agree with them. If then you ask them if that's a good thing or a bad thing, they'll say that chaos in the stock market is a bad thing.

We're coming to the conclusion that a lot of people have the wrong idea about chaos. For example, if you ask someone if the stock market is a pretty chaotic place these days, they'll say it is and what's more, we'll agree with them. If then you ask them if that's a good thing or a bad thing, they'll say that chaos in the stock market is a bad thing.

But is it really? Here's the thing we're finding out about chaotic systems: Chaos is where all the basic rules apply, but outcomes are difficult to anticipate because of the complexity of the interactions involved.

What makes those interactions complex is the effect of interdependencies in the market. At any given time, investors are dependent upon new information coming into the market, which drives their expectations of how the companies in the stock market will do in the future. Those expectations, in turn, directly drive stock prices and, as we've previously demonstrated, it is dividends per share, the sustainable portion of corporate earnings, that is the key driver of the value investors place upon stock prices.

Want to see how that works in practice?

In our fourth anniversary post, we hinted that dividend futures data might be pretty important in presenting our first chart specifically looking at a closeup of the acceleration of both the growth rate of stock prices and the growth rate of dividends per share for the S&P 500:

Let's next zoom in on the arbitrary ten year period from 2001 through 2011. We've selected this time frame since we have dividend futures data extending midway into 2010, which we wanted to incorporate for its potential relevance.

Today, we're going to demonstrate how that dividend futures data is especially relevant in setting the growth rate for stock prices. We'll begin by first considering the oldest futures data we had recorded for a different project, from 22 October 2007, which we'll present in a chart showing the accelerations of the growth rate of stock prices and trailing year dividends per share for the S&P 500 through October 2008:

Here, we see investors acting contemporaneously with the then new information that corporate dividends were going to suffer in the fourth quarter of 2008. Stock prices sharply accelerated downward to coincide with that change in investor expectations for the growth rate of dividends per share.

But we also see that the dividend futures data at the time suggested that the rate of decline in those dividends would soon slow. Stock prices could be expected to decline, but at a slower rate. Our next chart is excerpted from our fourth anniversary post, which shows where dividend futures were expected to go as of 9 December 2008:

Here, we captured the acceleration of stock prices through November 2008. More importantly though, this chart demonstrates that as of early December 2008, investors were focusing upon where the change in the growth rate of dividends per share would some three months ahead, or rather, where they would be at the end of the first quarter of 2009, and that information drove the change in the growth rate of stock prices for November 2008.

We'll next move up to 20 January 2009. The big change here is that investors now had new information of how the companies of the S&P would fare to the end of the third quarter of 2009 and adapted the value of stock prices accordingly. We visually confirm that investors were focused on the data through the third quarter of 2009 with the nine-month "leftward" shift in the dividend data.

Finally, here we are about a month later. Here's the updated version of that chart showing the acceleration we determine for the growth rate of stock prices as of 18 February 2009, coupled with the acceleration of the growth rate of the index' dividends per share effective 19 February 2009:

With the dividend data being shifted eight months to the left, we confirm that it is the change in the value of the expected growth rate of dividends per share through the end of the third quarter that has driven the change in the growth rate of stock prices at this point in the month of February 2009.

And that is our direct evidence of the order that underlies the apparent chaos of the stock market. It's not definitely not a bad thing because it clearly demonstrates that what's happening in the markets isn't random, but is rather the rational response of investors reacting to information as they receive it. What's more, it's not hard to put this kind of analysis together, the only difficulty we have doing it arises because the interactions we're observing are complex. As a practical matter, our experience to date (and remember, we've only been doing this since December 2008) is that you can work out either how much things will change, or perhaps when they will, but not necessarily both simultaneously.

Speaking of which, using today's dividend futures data, look at what's likely next in the cards for stock prices, barring new information that would whack the level of dividends per share expected to be paid out in the foreseeable future. We're just happy we have a second datastream that supports the limb we've already climbed out upon!

Image Credit: Debt Help

Labels: chaos, dividends, forecasting, SP 500, stock market

When it comes to mobility, people are creatures of habit. Most people spend about 40% of their time in just two places with much of their remaining time spent visiting anywhere from 5 to 50 other places, which they visit with diminishing regularity. What's more, we can predict the likelihood that an individual is a certain distance away from their preferred two places.

When it comes to mobility, people are creatures of habit. Most people spend about 40% of their time in just two places with much of their remaining time spent visiting anywhere from 5 to 50 other places, which they visit with diminishing regularity. What's more, we can predict the likelihood that an individual is a certain distance away from their preferred two places.

We know this because the typical daily travel of a large sample of people was tracked and analyzed by Marta C. González, César A. Hidalgo and Albert-László Barabási, who studied the trajectory of 100,000 anonymous mobile phone users over a six-month period of time and found that when it comes to mobility patterns, the distance humans travel is remarkably predictable. Their findings are presented in the June 2008 paper Understanding Individual Human Mobility Patterns.

Using the geographic data provided by the observed sample's mobile phone use, which allowed the researchers to determine the location of the tracked individuals with respect to the cell phone towers through which their calls were processed, González, Hidalgo and Barabási observed that human mobility was not random, but rather best described by a kind of probability distribution called a Truncated Lévy Flight (TLF). This kind of probability distribution was first introduced in 1996 by Rosario N. Mantegna and H. Eugene Stanley and is a special "bounded" case of a "fat-tailed" probability distribution first described by French mathematician Paul Pierre Lévy and known as a Lévy flight.

Here, the distance traveled by an individual follows a power-law distribution. Most distances people travel are short, but there is a significant probability that individuals will travel a long distance, more so than would be predicted using the well-established statistical math given by a normal probability distribution. Since the distance an individual can travel is not infinite, the probability distribution given by Mantegna and Stanley's truncated Lévy flight works best to describe the likelihood that an individual has traveled a certain distance.

We thought it might be fun to build a tool using the results of Gonzalez, Hidalgo and Barabasi's study to find the probability that an individual has traveled a given distance that the authors have referenced with respect to a typical "radius of gyration," which we'll describe as being the distance typically traveled between "home" and "work", or in the authors' terminology, an individual's "preferred locations."

We'll conclude that this kind of information might be really useful is in fighting communicable diseases, where knowing how mobile people are can help better focus epidemic prevention efforts. For our interests, the kind of math described by this research is very similar to that which can best describe how stock prices change over time.

If you're a regular reader of Political Calculations, you might be surprised to find out that some of our better analytical work doesn't even appear on our own site. And we're okay with that!

If you're a regular reader of Political Calculations, you might be surprised to find out that some of our better analytical work doesn't even appear on our own site. And we're okay with that!

Here's an example, using our favorite industrial punching bag, the auto industry*. Our long-time readers will recall that we used General Motors (GM) as the model company for our tool for predicting bankruptcy back in June 2006. But, we had only presented our analysis of GM's financial situation on our site just that one time (we found that GM was very much a distressed company even in those days of surging SUV sales.)

But our analysis of GM didn't stop there. Back on 2 October 2008, Ironman re-ran the Z-Score calculation for GM to support a comment over at Econbrowser. To save the clicking (and scrolling) through all those comments, here's what Ironman found:

In the past week, Political Calculations has had an upsurge in traffic for our Predicting Bankruptcy tool, much of it directed from the Yahoo! message board for General Motors.

Even though the default data set up in the tool shows that GM was highly distressed back in March 2006 (their Altman Z-Score was 0.01 back in those rosy days), updating it with the most recent quarterly data as of 30 June 2008 reveals that things have become much, much worse. Their Altman Z-Score is now -1.35, which is the lowest I've personally ever seen.

Perhaps that helps explain why the Congress provided $25 billion for the auto industry in their bailout package. At this time, I don't believe that even if the full amount went to GM that it would be enough for them to avoid bankruptcy proceedings.

In that Econbrowser comment thread, Ironman later responded to a question asked regarding that summer's 25 billion-dollar bailout for the auto industry would be sufficient to save GM:

"Whither General Motors? I want to know but, frankly, my crystal ball is a bit hazy these days. Is that US$25 billion loan guarantee provision sufficient to keep GM afloat?"

No. They would have to receive all the $25 billion (it will be split with Ford and Chrysler), and even if they did get it all, it would only reduce their Altman Z-Score to -0.96. Reorganization via bankruptcy is in their future.

But wait, that's not all! Ironman also responded to a question of whether the government would be obligated to continue bailing out GM to preserve the company's excessively generous pensions:

"However, if the company fails, would not the politics dictate that the US government intervene to save pensions and so forth?"

Not necessarily. Remember that GM offered pension buyouts to all its long term production workers back in February 2008. By the end of June 2008, some 35,000 of the 74,000 eligible direct GM employees took the offer. The pensions for those employees no longer factor into the company's equations.

Also recall that per the newest contract between GM and UAW, the pensions for all new employees (and many of the current employees) are now based on a defined-contribution pension plan, which do not have funding risk that the older defined-benefit type pension plans do. As such, there's not much risk to pensions, so I wouldn't anticipate government action on that count.

For myself, I'd prefer to see a serious restructuring that doesn't involve bankruptcy proceedings - the moves they've taken would pay off in a more normal business environment. Given the circumstances of today's less-than-normal market for U.S. automakers, I just don't think that's in the cards for GM.

And that was before the bottom really dropped out of the new vehicle market!

So, why do we bring all this back up today? GM was a major beneficiary of the recent so-called "stimulus package" recently signed into law, which turned the bailout money the company previously received into a tax-free gift from the U.S. taxpayers. Also, neither the company's management nor the bosses of its labor unions are seriously addressing its much needed financial and organizational restructuring, both parties hoping instead that their demands for new taxpayer gifts provided by a blindly-spending Congress and President intended to keep the company afloat will let them keep kicking that can down the road indefinitely.

That rent-seeking process by the company and its politically influential unions needs to stop. As the perfect T-shirt for our time says, "Suck it up Princess." Bankruptcy is your future. The sooner you princesses in the auto industry face it, the better.

* In the interest of full disclosure, we should probably reveal that Ironman did, in fact, previously work in the auto industry. Ironman is also either formerly or currently, and quite possibly, simultaneously employed as some kind of web developer, researcher, business analyst, rocket scientist, editor and quite possibly, a teacher of some kind or another. The scary thing is that's not even close to being a full list of Ironman's professions and we should potentially acknowledge that Ironman may or may not be one person. We'll leave it to our readers to sort out which Ironman might behind any of the posts that do appear here or comments that appear elsewhere on the web!

Image Credit: Gift Guide for Guys

Labels: bankruptcy, forecasting

Normally, we read Australian professional trainer and motivational speaker Craig Harper's blog for the unique combination of remarkable insights and casual writing that makes the blog an absolute joy to read. Today, we're going to highlight a T-shirt that Craig and his team have recently designed and begun selling, even though we will recognize no financial gain from doing so, simply because it represents genius marketing as it is clearly the right product in the right place at the right time.

We know what you're thinking: "A T-shirt?! How can a T-shirt possibly be the right product in the right place at the right time?"

Well, Craig doesn't know either, but it clearly has touched a nerve as it delivers a message that needs to be heard. We'll let a picture of the T-shirt do the talking:

Think about it. You want the T-shirt. Maybe it's so you can say what needs to be said to somebody who's just a little too whiney about themselves. Maybe it's so that CEO, Wall Street-type or those other crooked money-grubbing rent-seekers seeking bailout or stimulus money from the taxpayers can finally see exactly what you think of them and what they really need to do with their lives. Maybe you would just like a black T-shirt with a catchy saying to wear while you work out. No matter what it is, and even if you can't put your finger on it, you want the T-shirt because of what it says and how it cuts through the noise because it is the right product in the right place at the right time.

Speaking of which, here's how you can get one:

T-shirts are $30AUD including postage and handling in Australia and $42AUD including postage and handling overseas. If you would prefer to order your t-shirt over the phone please contact John on:

Australia (03) 9553 8857

International (+613) 9553 8857or email him at johnatcraigharperdotcomdotau

Or just click through this link and order directly from Craig's site. For those of you considering placing orders from outside Australia, here's our calculation of the international price (including shipping) of $42 Australian dollars (AUD) as of 16 February 2009, via XE's Unversal Currency Converter:

| "Suck It Up Princess" T-Shirt International Pricing (with Shipping), 16 February 2009 | |

|---|---|

| Country | Price |

| United States | 27.35 USD |

| Canada | 34.03 CAD |

| Great Britain | 19.11 GBP |

| European Union | 21.34 EUR |

What else can we say? It really is genius marketing!

Labels: none really

We're putting on our tri-cornered hats today in providing this heads-up alert! Our site traffic confirms that something likely wicked this way comes, by way of the U.S. Senate:

|

|

|---|

We spotted them first as they examined tax credits vs tax deductions, and today again as they were looking to find the distribution of U.S. taxpayers by tax bracket.

Note: We have a more accurate version of the distribution of taxpayers by household income, which includes a tool that you can use to extract data from it!

The two site visits together indicate that the taxers of the U.S. Senate are likely getting geared up for whatever push they're going to make. If you're looking to get out in front of what's coming, we would suggest that now's the time to do it.

And if you want to do it right, you'd best go in sufficiently armed with your own, better income tax plan.

At the very least now, you can't say you weren't warned....

Labels: taxes

Welcome to the Friday, February 13, 2009 edition of On the Moneyed Midways, where today is your lucky day for finding the best of the past week's money and business-related blog carnivals!

Welcome to the Friday, February 13, 2009 edition of On the Moneyed Midways, where today is your lucky day for finding the best of the past week's money and business-related blog carnivals!

It never fails. The week or so after we rant about organizing a blog carnival around a timely event or holiday is a recipe for disaster, along comes an example of how to do it right. This week, that honor goes to the Carnival of Real Estate's Valentine's Day-themed carnival, which is simply well done. If more carnival hosts took this week's host's approach, we'd have a lot less dread going into those weeks where there's a greeting card holiday involved....

In other news, we've finally broken away from blogrolling.com for managing our blogroll. They've had technical issues for some time, but with no end to those issues in sight, we finally took matters into our own hands and made some much needed updates. Why explain this here in this week's edition of OMM? Well, our frequent readers will recognize the much belated addition of the Best Blogs We've Found and a number of other excellent blogs to our rolls - if you're looking for solid reading, you won't be disappointed by clicking your way through our list of the best!

Speaking of solid reading, the best posts we found among the business and money-related blog carnivals of the week that was are just a mouse click away....

| On the Moneyed Midways for February 13, 2009 | |||

|---|---|---|---|

| Carnival | Post | Blog | Comments |

| Carnival of Debt Reduction | Second Stimulus Check for Obama 2009 Economic Stimulus Package? | Money Blue Book | Raymond analyzes the Obama administration's proposed stimulus package and wonders if it wouldn't be smarter to simply write each taxpayer a really big check this time around. |

| Carnival of HR | Is Human Bias Helping You Lay Off the Wrong Employee Talent? | Maximizing Possibility | If you're the boss, how can you be sure you're protecting your business by hanging on to your best talent when you're going through a period of layoffs? Chris Young describes the dilemma facing managers in distressed businesses and offers an objective solution to overcome the danger of favoritism. |

| Carnival of Personal Finance | Why You Should at Least Learn to Bake | You Might As Well Burn $5! | We really shouldn't review blog carnivals before having breakfast, but hopefully that explains why we found Margaret's $0.25 near-coffee shop grade blueberry muffins so appealing! |

| Carnival of Personal Finance | Getting Out of Debt | My Dollar Plan | Madison DuPaix tells the story of how she helped her brother-in-law overcome a situation where he was out-of-work and racking up massive credit card debt while avoiding bankruptcy. Absolutely essential reading! for providing the game plan anyone in similar circumstances can follow. |

| Carnival of Real Estate | Short Sale Listings: Leaving Out Key Details Is Like Telling a Lie… | Rain City Guide | Courtney Cooper advocates for the need for honesty and transparency on the part of listing agents who are making transactions more unlikely by not fully disclosing a property's short sale status in their listings. The Best Post of the Week, Anywhere! simply because these principles apply all the way up the financial food chain! |

| Carnival of the Capitalists | Business Models | The Dax Files | Dax Montana considers the things that barbers, hairdressers and restaurants have in common that make their business models successful, then asks why don't doctors and hospitals follow their example. |

| Cavalcade of Risk | You've Got Money: Invest It All or Dollar Cost Average? | Digerati Life | What if you had a sudden financial windfall and you were looking for how to best put your money into investments to work for you? The Silicon Valley Blogger considers three options: Lump Sum Investing, Value Cost Averaging and Dollar Cost Averaging - click through to find out the advantages and disadvantages of each! Absolutely essential reading! |

| Festival of Frugality | Why Do Frugality Tips Suck So Badly? | Mighty Bargain Hunter | As often as we review frugal tips contributed by bloggers to frugality and personal finance-related blog carnivals, we have to admit that we have the same question. MBH explains why its not the tips, so much as it’s the expectations for them…. |

| Leadership Development Carnival | Evolving from Manager to Leader | Software Project Management | Pawel Brodzinski outlines six things a manager needs to bring to their team to be more than just an administrator. |

| Money Hacks Carnival | Smart Refrigeration Lowers Electricity Bill | FIRE Finance | Hack your refrigerator! The folks at FIRE Finance tell you how to do just that with a number of tips for getting cooler food at a lower cost! |

| Carnival of Money Stories | Even Your Friends Can Screw You | M Is for Money | Miss M tells how relying upon a friend in financial transaction won't protect you when they put their interests ahead of yours. |

Previous Editions

- OMM's Running Index for 2008

- OMM's Running Index for 2007

- The Best Blogs Found in 2006 (and our full 2006 index)!

Labels: carnival

If you were a corporate CEO, when would be the right time to write losses off your books?

- Never.

- Shortly after you take over from the previous CEO.

- Within three months of when you discover that the activity you're writing off will never be profitable, nor will it enable other projects that your company has undertaken.

- When every other CEO is writing off losses on their books.

If you're a scrupulously honest CEO, the right answer is C. But, if you're a politically astute CEO, you recognize that the correct answer depends on timing and circumstances, which means that either B or D is the correct answer for you.

Here, you recognize that you have unique opportunities tied to unique events, which you can use to your advantage simply because the stakeholders in your business expect changes and will be less likely to resist your efforts to impose them.

That thought occurs to us today, as we've just reviewed the latest projection of corporate earnings for the S&P 500. Needless to say, compared to the last time that we looked at these earnings less than two weeks ago, a lot of CEOs would appear to be leaping all over themselves to get all the bad news and losses out while they can:

Update 25 February 2009: Quick heads up for Barry Ritholtz' fans! The trailing year earnings data in particular has continued to slide since we created this chart. The following numbers shown on the chart would change as follows (at least as of 23 February):

2008-Q4’s $28.75 would now be $26.16

2009-Q2s $19.79 would now be $14.37

2009-Q3’s (not indicated) would now mark the bottom for earnings at $12.62

2009-Q4’s $41.88 would now be $32.41

The forecast earnings slowly improves from there. Note also that forecast trailing year dividends per share has declined from $24.90 to $24.60. Our original source for the data is S&P’s Earnings and Estimates spreadsheet.

Yeah, we’ll have to make a new chart. Soon....

We'll let S&P analyst Howard Silverblatt explain (note - this link to S&P's PE Estimates and Earnings spreadsheet is frequently revised, the comments below were present on 12 February 2009):

With 81.2% of the market value and 363 issues reported, operating earnings are coming in -61% below Q4,'07

Reported quarterly sales are down -10.16%; 41% higher Y/Y (avg +6.54%), 59% lower (avg -18.82%)

As Reported earnings are negative for the quarter, with or without Financials (positive ex/Financials and COP)

House cleaning should be massive enough to keep first half of '09 clean of 'items', after that it depends on the economy

A previous version of this document had noted that CEOs were apparently throwing everything including the "kitchen sink" into the items they were writing off, trying to strip their books of all the potential bad news they could.

Meanwhile, Howard Silverblatt finally manned up (as opposed to "chickening out") and released his estimate of trailing year dividends per share for the S&P 500 for calendar year 2009!

He now projects the indicated dividend rate for the S&P 500 will be $24.90 for 2009. We used this estimate to project where 2009-Q1's dividends per share will come in at and combined that estimate with what the dividend futures market is expecting as of 12 February 2009 to produce our overall forecast of where dividends per share will go for 2009, which we've graphically presented in the chart above.

Labels: dividends, earnings, forecasting

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.