Scroll down for update!

Barry Ritholtz is pessimistic this morning:

Note the question mark in the title — is this the same gig as yesterday? Yesterday morn also had Dow Futures off triple digits, but it was less of a sell off than implied.

But it didn't seem to matter much– markets rallied after the open, and closed much better than the futures would have suggested.

Is today more of the same, or is the overdue correction imminent.

I suspect the latter.

Should we really expect stocks to drop today? And if so, why?

Answering the second question first, based on the kind of analysis that we've developed, we would expect stock prices to drop today (and stay down) if a company, or number of companies, representing a significant portion of the market capitalization of the S&P 500, were to announce that they would be slashing their dividends well into the future.

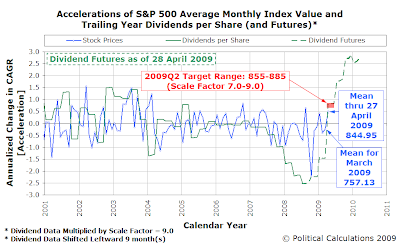

The key observation we make in this chart is that, at least since dipping from 21 April through 23 April, there has been no significant decline in the expected future level of dividends per share for the S&P 500. In the absence of a decline in the dividend futures data, we would not anticipate a decline in stock prices, or more accurately, if such a decline did occur today, we would view that decline in stock prices as being the result of noise rather than fundamentals.

But that begs the question: where do we expect stock prices to go, even if we don't expect them to drop today?

Consequently, we see stock prices today being pretty much where they ought to be.

Are We Really Any Good at This?

Maybe. You'll need to be the judge.

We've been progressively building a pretty decent, but not perfect track record using an analytical method that we've developed for anticipating the direction and magnitude of changes in stock prices. The method takes changes in the future rate of growth of dividends per share for the stock market and shifts those forward looking expectations to the current day, amplifying those changes into a corresponding change in the growth rate of stock prices.

Using that kind of analysis, we've been able to anticipate that the market had lower to go before hitting bottom back in early March 2009, when and where it would go after it hit bottom (here's our snapshot marking that occasion), that a sudden large drop in stock prices was nothing to be concerned about and most recently, when the market recently provided an unexpected buying opportunity for investors that we bet our own money on!

Update 28 April 2009, 9:00 PM PDT: Looks like we won the call today, as the S&P 500 closed down just 2.35 points at 855.16. However, it also looks like Barry will get some of his pessimism reinforced tomorrow - here's the forecast dividend futures for 29 April 2009:

Not enough for us to alter our overall projection for the second quarter of 2009 at this point, but enough we think to move stocks a touch lower tomorrow. Then again, who's to say that another IBM-type announcement isn't in the works somewhere in an S&P 500 boardroom?

Update 29 April 2009, 10:30 AM PDT: Well, what do you know?... Just for reference, XOM represents 4.46% of the S&P 500 by market cap.

Update 30 April 2009, 7:15 AM PDT: It looks to us as though there may be a short term selling opportunity developing. Although what we're seeing in the market these last two days fits our expectations for where stock prices will be for the quarter, we recognize that the market is likely getting ahead of itself in the short term, with stock prices going up while their underlying dividends per share (and the corresponding accelerations) are headed downward, as the market would appear to be being driven more by noise rather than signal. Here's the picture for the expected future dividends per share as of 30 April 2009:

We dug deeper into the individual stock dividend futures between yesterday and today, and found that they indicated that ExxonMobil had been expected to increase their dividend payout to $0.45 per share, rather than the $0.42 they actually did, which accounts for much of the decline we see in dividend futures for today.

Let's just say that we would not be surprised to see a pullback in the next several trading days.

Update 4 May 2009, 8:00 AM PDT: And we got it. When we wrote the section above, the S&P had risen to 886 at 7:30 AM PDT (10:30 AM EDT). Shortly thereafter, the S&P 500 dropped to close the day at 872.81, a drop of roughly 1.5%. This marked the short term buying opportunity we identified.

Today the market is up substantially (at this writing), which we'll note in a separate post, as changes in stock prices are now being measured from a new base. We're also going to change our focus with these posts, so we'll no longer be tracking the market in near real time, as we simply don't have the time available to do it (we're certainly not paid to do it!) Instead, we're going to be focusing more on more significant movements as they develop.

Labels: dividends, forecasting, investing, SP 500, stock market

Welcome to the blogosphere's toolchest! Here, unlike other blogs dedicated to analyzing current events, we create easy-to-use, simple tools to do the math related to them so you can get in on the action too! If you would like to learn more about these tools, or if you would like to contribute ideas to develop for this blog, please e-mail us at:

ironman at politicalcalculations

Thanks in advance!

Closing values for previous trading day.

This site is primarily powered by:

CSS Validation

RSS Site Feed

JavaScript

The tools on this site are built using JavaScript. If you would like to learn more, one of the best free resources on the web is available at W3Schools.com.