We made it another year without having to suffer through watching the annual abomination that is the Academy Awards ceremony this past Sunday, where Moonlight was declared to be 2016's Best Picture after La La Land was.

The blame for the Best Picture snafu apparently lay with Hollywood's accountants, who had broken away from their regular work and also their regular Sunday-night game of Three Card Monte to hand out cards in sealed envelopes identifying this year's "winners" to people who are professionally trained to read whatever words are put in front of them while on stage. So it couldn't possibly have been the Academy Awards' producers fault, because who could possibly have foreseen that such a thing could happen during a live televised broadcast? Especially after those four other times....

That wasn't even the day's only disaster. Earlier, a "giant prop" used as part of a background set for a performance number at this year's Academy Awards crashed down onto the stage, ripping a large curtain and crushing a camera during a break in the event's rehearsals. So far, nobody has fingered the Hollywood accountants as also being behind that incident, but fortunately, at least no one was injured.

And then, there was the untimely premature death announcment for Australian movie producer Jan Chapman, which came in the form of her photograph appearing during the Oscar's "In Memoriam" segment, where she had been misidentified as Australian costume designer Janet Patterson, who sadly did pass away back in October 2015. The auditors from PriceWaterhouseCooper couldn't be reached for comment regarding their potential involvement in that mix up.

These three incidents demonstrating exceptionally poor quality control on the part of the producers of the 89th Annual Academy Awards were in *addition* to all the mundane things that make the annual Academy Awards televised broadcast such an awful viewing experience year after year, most of which are actually planned to happen. We knew better than to watch it before the broadcast began, but considering what happened, we're even more against the idea of investing any amount of time to watch future Academy Award presentations.

If this were baseball, what happened at the 89th Academy Awards would be strikes one, two and three against Hollywood's producers. If we were looking to invest money to make either money or art by making motion pictures, we would rank the idea of doing that behind the opportunity to buy Turkish bonds at ground floor prices.

Speaking of which, what kind of people actually invest money to make movies these days?

Increasingly, the generic answer to that question in recent years has been "Chinese investors", where a lot of money has been cashed out of China's economy to fund both movie productions and the acquisitions of Hollywood movie studios. In return for that largesse, Hollywood's producers have become especially accommodating to Chinese interests.

These deals have sparked concern over whether China’s expanding influence in Hollywood could lead to more pro-Chinese propaganda in U.S. films. The Chinese government tightly controls media content, and Hollywood studios have been known to alter films to feature China or the Chinese government in a more flattering light to gain access to the country’s lucrative film market.

If you were to go out into today's movie theatres to see the result of that influence, you would need to look no further than The Great Wall starring Matt Damon, which may be considered to be a prime example of the intersection of Hollywood movies that were purposefully made to satisfy the Chinese government's sensibilities. The good news, if you can call it that, is that despite its bad reviews, it is reportedly much more watchable than the annual Academy Awards ceremony.

While the movie did alright financially in China, it got bad reviews in that country, even though it was crafted specifically for it. Meanwhile, two weeks into its run, it's clear that it won't be making much money from American audiences.

Hollywood is in desperate need of a turnaround artist to fix its multitude of problems. But can its current predicament, where poor quality defines its intended blockbuster products and absolutely permeates the televised award show where it purports to recognize the best work done within the motion picture industry, even be fixed at this point?

Believe it or not, the answer may lie with the Chinese government, who in its desire to halt the flight of capital from that country, is cracking down on Chinese businessmen to keep them from making "irrational" overseas investments in Hollywood film productions, among other unseemly investments, where they suspect that the investments are merely a means for moving large sums of money outside of the government's control.

Responding to the still-hypothetical question asked by Hollywood Reporter in response to that developing crack down, "What if China's money stream stops flowing to Hollywood?", Ed Driscoll speculated that the end of that flow of cash into Hollywood's odd accounting system might actually lead to better quality movies:

Movies might suck less, for one thing, since their plots and dialogue are often dumbed for foreign consumption — not to mention censored as well to placate the Chinese government. Or as even urban haute bourgeois* left Vanity Fair asked in August, "Did You Catch All the Ways Hollywood Pandered to China This Year?"

But would Hollywood movies not made to specifically pass muster with China's government do more poorly at the box office in that country?

There is an interesting example from the biggest money-making movie of 2016: Captain America: Civil War, which not only dominated the U.S. box office, it dominated box offices around the world, including in China.

Better still, it drew strongly positive reviews that praised the movie's intelligence:

Critics Consensus: Captain America: Civil War begins the next wave of Marvel movies with an action-packed superhero blockbuster boasting a decidedly non-cartoonish plot and the courage to explore thought-provoking themes.

If you go down the list of 2016's top money making films, you'll find similar global box office results and critical summaries for movies like Finding Dory, Zootopia and The Jungle Book, which all earned considerably more money overseas than they did in the United States while they were also critically praised for their thoughtful qualities.

The only exception in the Top 5 grossing moving of 2016 is Rogue One: A Star Wars Story, which wasn't cited for many thoughtful qualities by critics. And in fact, Rogue One was the only movie in the year's Top 30 that made more money in the U.S. than it did overseas.

Dumbing down a movie script to make it more appealing to another country's cinematic censors is the wrong way to go if Hollywood producers are really in the business of making entertaining or thought-provoking movies that make money. All things considered after this year's multiple Academy Awards fiascos however, we wonder if Hollywood's producers should even be considered to be part of the entertainment industry. If we had to guess, we would think that they're really in some form of organized crime, because that makes more sense than the accounting system they use.

Labels: academy awards

The Presidents Day holiday may have shortened the trading week that was the fourth week of February 2017, but unfortunately, squeezing the entire trading week into just four days didn't make the market's action any more interesting, despite the setting of new record highs. Our alternative futures chart, where we track actual stock prices against where our standard dividend futures-based model of where stock prices would project them to be based upon how far forward in time investors are collectively looking shows how unimpressive the market's movements have been over the past week.

Based on what we observe, the actual trajectory of the S&P 500 is running along the lower half of the range that our standard forecasting model would predict for investors being focused on either the very near term future of 2017-Q1 or the slightly more distant future of 2017-Q2. Which future quarter they're focused upon doesn't make much difference because their projected trajectories are nearly identical, which has been the case since 19 January 2017.

Now, the most likely reason for why investors would be so closely focused on either of these two quarters comes down to the expected timing of its next planned hikes in short term interest rates, which is why we've focused on the news headlines related to the expectations that Fed officials are seeking to set in our summary of the week's market-moving headlines. Which for Week 4 of February 2017, really represents the reasons for why the daily closing value of the market didn't move much at all during the week (considering that they were already focused on either 2017-Q1 or 2017-Q2 coming into the week)!

- Tuesday, 21 February 2017

- Cleveland Fed chief 'comfortable' raising rates if economy keeps performing

- U.S. economy looking good, Fed poised to hike rates: Harker

- Fed's Williams sees more financial stability risk with low rates

- Oil rises 1 percent as OPEC sees higher compliance with cuts

- Wal-Mart helps Wall Street's record-setting rally march on

- Wednesday, 22 February 2017

- U.S. home sales hit 10-year high, prices soar

- Federal Reserve minutes point to rate hike 'fairly soon'

- Rate hike 'relatively soon,' Fed watching March data: Powell

- Fed's Powell says March rate hike on the table

- Powell, keeping cards close, says Fed to gradually hike rates

- Oil falls on worries over swelling U.S. stockpiles

- Dow notches another record high helped by DuPont; S&P slips

- Thursday, 23 February 2017

- Friday, 24 February 2017

On a side note, with the Fed ending its Zero Interest Rate Policy (ZIRP), we've noticed an increase in interest in our "Reckoning the Odds of Recession" tool, which we haven't had much need to pay attention to over the last eight years with the Fed essentially holding its thumb on the scale for short term interest rates. For what it's worth, we think that the scale is still showing the signs of the Fed's heavy thumbprint upon it, so we think that it will still be some time before it might begin delivering useful information on recession probabilities for the U.S. economy.

Going back to the week that was, Barry Ritholtz has outlined the pluses and minuses for the U.S. economy for the trading week that ended on Friday, 24 February 2017.

Going forward to the week that will be, the next edition of this series will be for Week 1 of March 2017, keeping with our practice of assigning those weeks with a split in days between months to the month that supplies the most trading days!

Dominic Walliman's brief overview of the major fields and divisions within mathematics and how they generally relate to one another:

Our favorite sections of the map are the portions dedicated to dynamical systems and to applied mathematics. But then, that should be of no surprise to any of our regular readers!

HT: Barry Ritholtz.

Labels: math

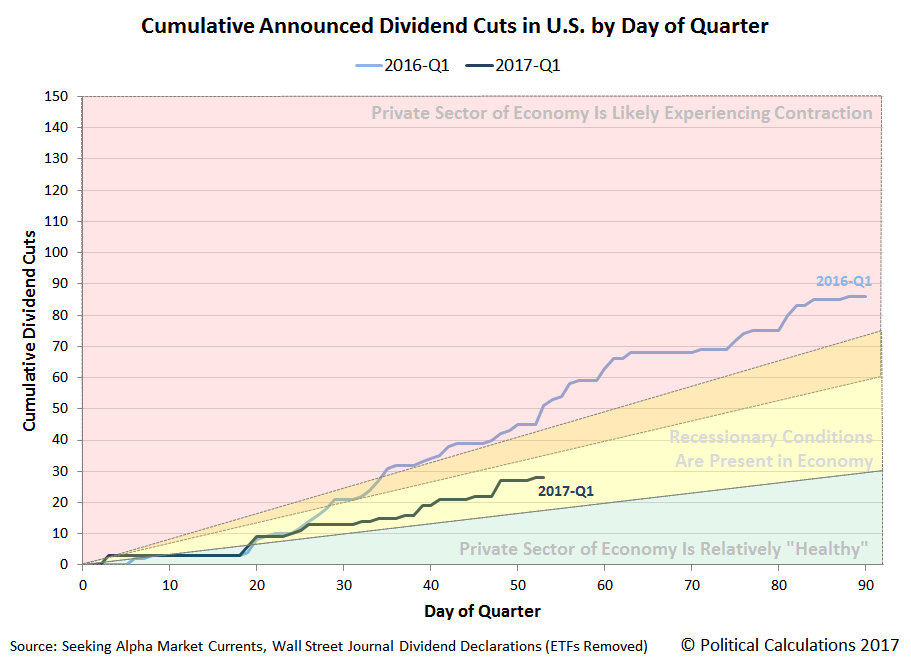

Dividend cuts in the first quarter of 2017 are being announced at a rate that is roughly 45% slower than what was recorded at the same point of time back in the first quarter of 2016.

We're basing that observation on the sampling of dividend declarations that our two real-time sources for those announcements have cumulatively indicated for 2017-Q1 through 22 February 2017, where the total number of dividend cuts they have reported has reached 28. Through the same point of time in 2016-Q1, those same sources had reported a cumulative total of 51. The following chart visualizes the cumulative trajectories of both 2016-Q1 and 2017-Q1.

The difference a year makes is being seen in the kinds of firms announcing dividend cuts. Back in 2016-Q1, the ranks of dividend reducing firms were swelled by an abundance of firms in the U.S. oil and gas industry, where through 22 February 2016, they had accounted for 33 of the 51 firms that had announced dividend cuts. In 2017-Q1, only 14 firms in the U.S. oil and gas industry from our sampling have declared that they are reducing their dividends as of 22 February 2017.

That's the difference between a sector of the U.S. economy that was in full contraction a year ago, whereas today, it can best be described as experiencing the lingering effects of recessionary conditions, which compared to that previous situation, is a clear improvement.

In 2017-Q1 however, we are seeing in increase in distress in the U.S. financial industry compared to what was recorded in 2016-Q1, with an uptick in firms that are negatively exposed to the effects of increasing interest rates, such as Real Estate Investment Trusts (REITS).

Data Sources

Seeking Alpha Market Currents Dividend News. [Online Database]. Accessed 22 February 2017.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed 22 February 2017.

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter's earnings. Today's snapshot of the trailing year earnings per share for the S&P 500 reveals that the stock market's earnings have continued rebounding off their 2016-Q3 bottom, but that they are growing at a slower pace than Standard and Poor had projected just three months ago.

At present, the earnings recession that began taking hold in the U.S. stock market in 2014-Q3, as falling oil prices impacted the earnings of U.S. firms in the energy production sector of the economy, appears to be set to be over sometime in the next few months as the S&P 500's trailing twelve month earnings per share recovers to their pre-earnings recession levels.

Data Source

Silverblatt, Howard. S&P Indices Market Attribute Series. S&P 500 Monthly Performance Data. S&P 500 Earnings and Estimate Report. [Excel Spreadsheet]. Last Updated 16 February 2017. Accessed 17 February 2017.

On 1 January 2017, the city of Philadelphia's new tax on the sale of sweetened beverages went into effect. Imposed on bottled and canned soft drinks made with either natural or artificial sweeteners, including those that add virtually no calories to the beverages being sweetened, the tax is aimed at reducing the incidence of obesity among Philadelphia's population, which the city claims to be a public health crisis.

Official revenue figures and updated obesity statistics from the city for the tax's first weeks in force are still pending, but Bloomberg has gotten a sense of how effective the tax has been at curbing sweetened soft drink purchases within Philadelphia's city limits from the retailers and distributors who fulfill the demand of the city's residents for the products.

Philadelphia’s six-week-old tax on sweetened beverages is already taking a toll on drink distributors and grocers, with some reporting sales drops of as much as 50 percent.

Canada Dry Delaware Valley -- a local distributor of Canada Dry Ginger Ale, Sunkist, A&W Root Beer, Arizona Iced Tea and Vita Coco -- said business fell 45 percent in Philadelphia in the first five weeks of 2017, compared with the same period last year. Total revenue at Brown's Super Stores, which operates 12 ShopRite and Fresh Grocer supermarkets, fell 15 percent at its six retailers in the city.

"In 30 years of business, there's never been a circumstance in which we've ever had a sales decline of any significant amount," said Jeff Brown, chief executive officer of Brown's Super Stores. "I would describe the impact as nothing less than devastating."

With sales having declined by that magnitude in its month and a half in effect, it's a safe bet that the city of Philadelphia will not be seeing the $91 million in revenue from having imposed the tax on the city's soft drink consumers that it was counting upon to fund the city's expanded prekindergarten programs, park improvements and to pay for the very generous raise that the city granted to municipal union employees shortly after the city council passed the soda tax.

The city's tax amounts to a 1.5 cents-per-ounce surcharge on top of what was the regular retail price for the bottled and canned regular or diet beverages sweetened with sugar or with a number of sugar substitutes, regardless of their relative effects on the health of consumers. A 12-ounce can would have its cost increased by 18 cents, while a 2-liter container would see its cost to retailers increase by over $1.00, which is as much as the retailers might have charged consumers for a 2-liter container of soda pop before the new tax was imposed.

Although directly levied on distributors, a significant share of Philadelphia's soda tax is passed through to consumers, just as the economics of tax incidence would suggest.

The higher taxes are drying up the distributors' business, with negative impacts on their ability to keep employees on their payrolls:

Canada Dry Delaware Valley Chief Operating Officer Bob Brockway said he expects his business will decline by at least a third over the course of the year. He distributes more than 20 percent of all soft drinks in Philadelphia market. Even though retailers just outside the city limits have gotten a sales bump, that increase isn't enough to offset the drop in Philadelphia. Brockway said he'll have to lay off 30 of his 165 employees in the area in March. Depending on summer sales, the layoffs will probably continue, he said....

At Brown's stores, many of which were established in places previously designated as food deserts, beverage sales are down 50 percent. Jeff Brown said he’s had to cut 5,000 to 6,000 hours of employment per week, the equivalent of about 280 jobs. Beverages are the biggest category in a grocery store, he said, with 4,000 products. When consumers drive outside the city to find cheaper prices, Brown said he's losing the non-beverage portion of their carts as well.

The city of Philadelphia could have avoided this situation if its leaders had been more honest in their rationale for imposing the tax, where if the city's leaders were truthful about their desire to address the public health crisis of obesity that they claim justifies the tax, they would have levied it across a wide range of products that share similar sweetened calorie content as the sweetened soft drinks they chose to tax, minimizing the effective tax rate to consumers.

They would then have dedicated the proceeds from that tax to funding to the city's public health programs to specifically address obesity related health concerns.

Ideally, they would also have acted to proportionately reduce other city sales taxes so that the total tax burden on people in the community where they apply remains unchanged. Otherwise, the impact of the new tax would be highly regressive in disproportionately impacting low income earners.

If the city government was then successful in reducing consumption of these products through the tax, the costs of the public health problems related to their consumption will also go down and they would be able to easily get by without the tax revenue from that source, without any impact to their ability to provide other city government services.

On the other hand, if they're not successful in reducing people's consumption of these products, then they'll have the source of revenue they need to address the public health problem they claim to be the justification for the tax.

But if the politicians advancing the tax use any part of the money they collect through the tax for some other reason, which is exactly what they've done in Philadelphia, they should stop claiming that the tax was for the purpose of addressing a legitimate public health concern and admit that it was all really a ruse to cram through the greater spending they desired.

Previously on Political Calculations

Labels: taxes

In Week 3 of February 2017, we closed out our five-week long prediction of the range into which the S&P 500 would close on each trading day from 5 January 2017 through 14 February 2017. The final results are presented in the following chart.

This is second time that we've attempted the feat with our "connect the dots" approach for coping with the periods where we know in advance that the accuracy of our standard forecasting model will be negatively impacted by the echo effect of past volatility, which arises as a result of our model's use of historic stock prices as the base reference points from which we project future stock prices. As with that previous attempt, stock prices generally fell within our specifically projected range (actually, this time they all fell entirely within the predicted range, whereas back in 2016-Q4, they dropped just outside our projected range on two trading days during that previous prediction period).

It will be another couple of week's before the echoes of past volatility will once again prompt us to attempt another override prediction, but until then, our standard model's forecast will stand - to read that forecast in the chart above, you just need to determine how far forward in time investors are looking as they go about making their current day investment decisions, then identify the range that coincides with that point on the investment horizon.

As best as we can tell right now, they're focusing on either 2017-Q1 or 2017-Q2, for which our dividend futures-based forecasting model doesn't make much distinction. That observation is based in part on the market-driving news headlines that came out during Week 3 of February 2017.

- Monday, 13 February 2017

- Tuesday, 14 February 2017

- Oil pulls back in post-settlement trade as U.S. stockpiles rise

- Fed official wants to trim, maybe sell, bonds this year

- The "Fed official" is Jeffrey Lacker, who's anxious to begin what might be called "quantitative tightening".

- Fed on course to raise interest rates at an upcoming meeting: Yellen

- If we go by our dividend futures-based model of how stock prices work, the Fed can get away with hiking short term interest rates at its meetings in both March 2017 and June 2017 without significantly affecting stock prices, seeing as the expectations for the change in the growth rate for dividends per share in 2017-Q1 and 2017-Q2 are nearly identical. If however the Fed's actions cause investors to shift their focus to either 2017-Q3 or 2017-Q4, stock prices will deviate from their current projected trajectory - downward in the case of 2017-Q3 and upward in the case of 2017-Q4.

- Meanwhile, for their part, other Fed officials covered the full range of hiking options that they are now considering in the rest of the day's headlines dealing with the specific timing of future rate hikes.

- Wall Street hits record, dollar climbs after Yellen remarks

- Wednesday, 15 February 2017

- U.S. industrial output falls as warm weather curbs heating demand

- Fed's Rosengren sees 'at least' three rate hikes per year

- Fed's Harker sees three interest-rate hikes appropriate for 2017

- Fed aims to hike rates, based on more growth and fiscal stimulus: Dudley

- Wall Street rises further into uncharted territory

- Stock markets are doing so much winning, investors are thinking Nasdaq 6,000

- Thursday, 16 February 2017

- Friday, 17 February 2017

The Big Picture's Barry Ritholtz spelled out the pluses and minuses in the news for the U.S. economy in the trading week ending on Friday, 17 February 2017.

Two years ago, Ramiro Gómez created a map that says as much about civilization as photographs of the lights from cities at night from space: a map of all the pubs in the United Kingdom and in Ireland.

A little over two years later, computer scientists from the University of Waterloo in Canada have managed to connect all the dots that fall within the United Kingdom, as they used an algorithm they developed to solve a unique version of the "traveling salesman problem", to connect the dots in the shortest amount of distance without repeating any stop.

The result, of course, can only be described as the world's most epic pub crawl....

HT: Frank Jacobs.

Labels: data visualization, math

Mark Bertolini is the CEO of Aetna (NYSE: AET). Yesterday, he gave an extended interview with the WSJ's Dennis Berman on the topic of the future of health care, in which he made big news by describing the Affordable Care Act (ACA), which is more popularly known as Obamacare, by saying that "it is in a death spiral."

But the part of his comments that really stood out to us came just after the 14-minute mark of the interview, where he said:

You know that mathematics education in the United States is working when someone says, let's see, I'm going to pay this much premium, I've got a $6,000 deductible, the average deductible across the country is $3,600 dollars, it's up 15% this year alone, right, and when I go to the doctor I'm going to pay cash, nobody anticipates spending a day in the hospital or going to the doctor more than once... so premium, plus deductible, plus paying cash... why do I do this? I'll just pay the penalty and move on.

We here at Political Calculations have been happy to help provide Americans with that particular mathematics education since 17 September 2013, when we introduced our tool "ObamaCare: Should You Pay the Premium or the Tax?" (a 2017 version is also available), in which we made the kind of personal finance math described by Bertolini easy to do for any American with an Internet connection.

So, in a way of speaking, we're the solution to the game of Clue featuring the all-but-confirmed death of Obamacare: it was Political Calculations, on the Internet, with Math!

That said, we do have some thoughts on how to address the situation that Bertolini describes as the result of the adverse selection that has drawn in the sickest Americans eligible for Obamacare while driving out the healthiest Americans. In our view, that outcome will be exceptionally valuable in making good on the failed promise of Obamacare to provide people with pre-existing conditions with the ability to obtain affordable health insurance coverage. Unlike the other failed Obamacare promise that "if you like your health care plan, you can keep it", we think it may be possible to make that kind of health insurance portability a reality, so long as it can be separated from the all the other, excessively wasteful baggage of the Affordable Care Act.

If you want a teaser, we think that the solution to that issue is not subsidized health insurance, but rather reinsurance, which is an idea that we'll explore more at a later date.

In the meantime, if you'd like to see what else Aetna's CEO had to say on about the future of health care, here's the WSJ's full video of the 50-minute interview, but we'll warn you in advance that it starts off with over four and a half minutes of some especially awful background music before it gets going.

Labels: health care, health insurance, math, personal finance

For the sixth month in a row, the exports of soybeans from the U.S. to China led to a year-over-year surge in the exchange rate adjusted growth rate of trade between the two countries. The following chart shows the spike in the growth rate of U.S. exports to China through the end of 2016, which closely resembles the previous spike in 2013 that was also driven by the mass export of that year's bumper crop in soybeans.

At the same time, the year over year growth rate of goods imported by the U.S. from China continued to rise into positive territory, suggesting growing strength in the U.S. economy.

Focusing on U.S. soybean exports again, the following chart shows our estimates of the volume of monthly exports of soybeans from the U.S. to China for each month of 2016 with respect to the amount of soybeans exported during those months in previous years.

In real terms, or rather, the terms of the quantity of U.S. soybean exports, 2016 is the best year on record, with the greatest contribution coming in the third quarter of 2016. The conditions that led to that outcome must be considered to be unique however, in that the world's second largest exporter of soybeans, Brazil, experienced a drought that reduced that nation's crop yields, which prompted China to turn to the U.S. market earlier in the year to fulfill a significant portion of their demand.

At the same time, thanks to nearly ideal growing conditions, the U.S. had a bumper crop of soybeans available to export - the largest since 2014.

Combined, those two factors delivered a real boost to the U.S. economy from the export of soybeans to China in the third and fourth quarters of 2016, with the third quarter benefiting more from the unique circumstances that made those increased exports possible.

Looking forward, we can expect the economic growth that will likely be reported in the first quarter of 2017 to be somewhat pale by comparison, since U.S. soybean exports will no longer be a significant contributor to economic growth. And given those unique circumstances, it is unlikely that the U.S. will see a similar year-over-year spike in exports to China when 2017's soybean export season comes around in the second half of 2017.

Data Sources

Board of Governors of the Federal Reserve System. China / U.S. Foreign Exchange Rate. G.5 Foreign Exchange Rates. Accessed 7 February 2017.

U.S. Census Bureau. Trade in Goods with China. Accessed 7 February 2017.

Labels: trade

Like lots of Americans, President Donald Trump hates the hassles involved with filing and paying personal income taxes. But unlike lots of Americans, he's in a position where he is going to exercise some influence over the issue.

Like lots of Americans, President Donald Trump hates the hassles involved with filing and paying personal income taxes. But unlike lots of Americans, he's in a position where he is going to exercise some influence over the issue.

But why should he have all the fun?

When it comes to making personal income taxes easy, not much comes close to the flat tax, where we've made it possible for you to develop your own hypothetical personal income tax system for the entire United States. All you need to do is set the tax rate and enter the value for an individual tax credit into our tool below, and we'll figure out how well your personal income tax plan would mean for both you and the country if the U.S. Congress went along with it! [If you're accessing this article on a site that republishes our RSS news feed, please click here to access a working version on our site.]

If you've run the tool with our default data, you've found that we've nearly matched the U.S. government's actual personal income tax collections without much straining.

But maybe the better question is would President Trump go along with such a simple flat tax plan, considering that what he proposed during the campaign was so different. Not that proposal means much at this point other than that the President will indeed seek to cut taxes, because with Trump, many of his proposals are more often than not just the opening bid for a big negotiation.

One last thing. The U.S. already has, for all practical purposes, a flat tax of 35%, where the rate is set that high to account for all the games that U.S. politicians have played with the tax code over the years at the behest of their most influential donors and their desire to buy lots of votes through popular tax deductions, exemptions, credits and eligibility for various welfare benefits. Regardless of how much income you have, that works out to be the average effective marginal tax rate that people across the entire income spectrum pay.

Since we're in for a negotiation, we might as well know where we stand today so we know if the deal that's offered is a good one!

About the Tool

We used our model of the 2010 aggregate distribution of household total money income for the U.S. in generating the "how would the federal government do with your flat tax?" portion of the tool, along with the U.S. GDP and the IRS' count of the number of exemptions reported on tax forms for 2010.

The rest was just simple math! (Trust us - you should see how the IRS does quadratic equations!)

Data Sources

White House Office of Management and Budget. Budget of the United States Government: Historical Tables Fiscal Year 2012. Table 2.1 - Receipts by Source: 1934-2016. [Excel Spreadsheet]. 14 February 2011. Accessed 28 September 2011.

Bureau of Economic Analysis. National Income and Product Account Tables. Table 1.1.5 Gross Domestic Product for 2010. [Online Application]. Accessed 13 February 2017.

Internal Revenue Service. Selected Income and Tax Items for Selected Years (in Current and Constant Dollars). Individual Complete Report (Publication 1304), Table A, 1990-2010. [Excel Spreadsheet]. Accessed 13 February 2017.

Image Credit: RealClearMarkets.